Ideal Customer Profile (ICP): How To Create A Comprehensive Customer Profile

The goal of this article is to show how to create a 360-view of your customer and what characteristics you should consider when selecting your ideal customer profile and persona.

The goal of this article is to show how to create a 360-view of your customer and what characteristics you should consider when selecting your ideal customer profile and persona.

Table of Contents:

Part 1: Introduction

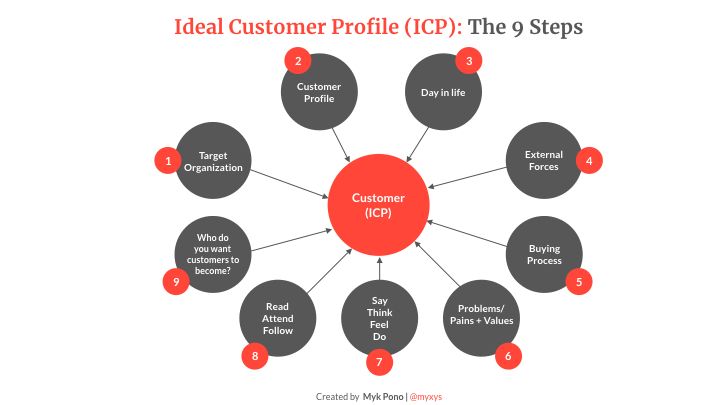

Part 2: The Nine Elements of Ideal Customer Profile

1. Target Organization

2. Customer Demographics

3. Day In The Life of Your Customer

4. Environment or External Forces To the Market

5. Customer Acquisition Process: How Your Customers Buy

6. Pains & Problems vs. Values

6.1. Awareness vs Urgency

6.2. Frequency vs Severity (or Impact)

6.3. Business vs. Personal Values

7. Empathy: What Customers Say, Think, Feel, and Do

8. Read, Attend, and Follow

9. Who do you want your customers to become?

Part 3: Integrating ICP Into Your Strategy

Part 4: How To Gather Info About Your ICP

Summary

Resources

Free Course: How to Run Effective Customer/User Interviews

Course Outline: https://lab.mykpono.com/free-course-Customer-User-Interviews-13cbee28614780feb9b9fbe594eb145c?pvs=4

Part 1: Introduction

"Because the purpose of business is to create a customer, the business enterprise has two — and only two — basic functions: marketing and innovation. Marketing and innovation produce results; all the rest are costs. Marketing is the distinguishing, unique function of the business." - Peter Drucker

The goal of business is to create a customer by convincing someone to buy your product or service. The only way to achieve this goal is to truly understand the people whose lives you want to improve. How well an organization knows its customers defines the success of its product and brand. The organization that is closer than competitors to its customers will win.

Principle #1: The organization that is closer than competitors to its customers will win.

Understanding your customers is an essential step to building a product that people are willing to pay for. You have to put yourself in the shoes of your target customers to truly understand who they are and what they care about. Only then you can build a product that customers need and deliver it in an efficient way.

However, understanding your customers goes beyond merely knowing their pains and problems. Ask marketing or sales professionals to describe their customers and, more often than not, they’ll tell you all about their pain points. But understanding someone’s problems does not give you the whole picture. If that’s all you know about your existing or potential customers, you’re missing the context in which this pain occurs. Building empathy for your customers, in turn, creates brand credibility.

Let's say you want to buy a couch, so you go to a furniture store. A salesperson approaches and asks how she can help. You tell her that you need to buy a new couch. This is your primary problem or “pain point.” She asks a few questions and then recommends a few options depending on your budget and taste. However, the salesperson never asked you about the size of your room, how bright it is and what furniture is already there.

Principle #2: Context is everything.

This is exactly what happened to me when I was shopping for a couch. While the option a salesperson recommended fit my taste and budget, I felt it was too large for my place and might not fit well with my coffee table. This was obvious to me but not to the salesperson.

From the salesperson’s perspective, it's difficult to be aware of what she doesn’t know about her customer, and what she should know in order to provide a customer with the right option.

Similarly, in B2B sales, we are often aware of who our customers are and their problems. But that's not enough: Organizations must also understand the context in which their customers operate. We must know how their organizations operate, what their typical day looks like, what they feel about issues at hand, what events they attend, who they follow on social media, what they read, and what products and services they use and like. Building empathy with your customers in this way helps you create effective marketing and sales strategies that focus on your customers and not your product or service.

Most companies start the process by creating customer personas based on demographics and psychographics that include things like attitudes, values, and interests. They might find generic industry-specific personas online, or make assumptions based on what they think they know about their actual or potential customers. More often than not, these personas amount to guesswork. And there’s a better way.

Before you develop a persona and the ideal customer profile, take time to understand the broader audience. This knowledge will help you select the optimal customer segment to target and even the personas whose attitudes, values, and beliefs align with your organization. It will also form the basis of your go-to-market strategy.

Principle #3: You can't please everyone.

Here are the steps you can take to build a more comprehensive view of your customers.

1) Understand the larger target audience that might be feeling the pain that you are solving. For example, say you offer training for sales reps. Your target audience might be VPs of Sales across organizations of all sizes or in any industry. However, the fact that people experience the same pains doesn't mean that they have an identical context. While every VP of Sales will find it important to train their sales reps, in a large organization, the VP of Sales has a larger budget to deal with this problem and can hire external coaches. In a smaller organization, the VP of Sales might have to coach direct reports herself.

This same approach works even for a consumer company. Let's take Petcube, a company that develops hardware and software products for pets, as an example. The target audience for Petcube is everyone who owns a pet.

2) Identify potential customers (people who have a particular problem that your product or service solves) out of the larger target audience group. For example, your potential customers might be VPs of Sales from organizations generating over $1M in annual recurring revenue (ARR).

Again, this works for consumer companies too. The price for Petcube products ranges between $100-$300. A potential customer is a pet owner with a budget to afford their products.

3) Build an ideal customer profile (ICP). Your ideal customer is prospects experiencing pain you can solve who are ready, willing, and able to buy your product or service. Ideally, the person who fits your ICP is aware of the problem and already looking for a solution. Continuing with the example above, your ideal customer profile could be VPs of Sales at organizations with over $1M ARR experiencing high turnover in the sales force due to poor training.

For the Petcube example, the ideal customer profile is a pet owner with enough disposable income to afford spending a few hundred dollars on their pet and currently looking for pet toys and products.

4) Create customer personas. Only after you understand the larger target audience and outline the primary target in the form of an ICP can you dig into the psychographic and personality traits — attitudes, beliefs, values, etc. — of your customers.

For Petcube, the persona is a pet owner with disposable income who is actively shopping for pet products and believes their pet deserves the best solutions to prevent loneliness.

The point to analyze the broad target audience before defining your ideal customer profiles and personas to ensure that you understand the market you are targeting and select the right targets. The diagram below summarizes the ICP and persona discovery process.

In other words, understanding your customers requires you first understand the whole marketplace and then zero in on an ideal customer profile to pursue. Understand first, then segment. It's also worth noting that picking the right market and the right customer can decrease your customer acquisition cost (CAC). It's easier to sell your solution to people who already familiar with the problem and it's even easier if your target customer is already in the market looking for a solution. We will come back to this point when we discuss how you analyze your customers’ pains.

Additionally, a go-to-market strategy that targets the right customers positively impacts customer lifetime value (CLV) and churn. Low customer lifetime value (CLV) and high churn is the result of selling to the wrong people -- those who aren't experiencing the problem you are solving or aren’t feeling enough pain to warrant spending whatever your product or service costs.

The goal of this article is to show how to create a 360-view of your customer and what characteristics you should consider when selecting your ideal customer profile and persona. Learning about your broad target audiences is the key to defining your ideal customer profile but it can be separated from the ICP creation process.

The ICP is the cornerstone of your brand story, strategic messaging, customer acquisition process, and content strategy. Therefore, every marketing playbook and every go-to-market strategy plan should start with a careful analysis of your market, defining your ICP, and deeply understanding your ideal customer from every angle imaginable.

A quick definition of an ideal customer profile is a customer:

- Experiencing the most pain (severity)

- Frequently experiences the pain (frequency)

- Actively looking for a solution (urgency)

- With a budget to pay for a solution (fit)

- For which your Customer Acquisition Cost (CAC) is lower than the Customer Lifetime Value (CLV) | CAC < CLV

As David Cancel, founder and CEO of Drift, said, “Today you are not going to win on product features -- you have to win on brand." In order to build a strong brand, you need to get attention from your target audience. To get the attention you need to make people care by showing them the vision and promised land. And to do that you must have a customer-experience-centric organization -- a company that closely understands its customers, their feelings, beliefs, and attitudes in addition to pains and concerns.

Your customer's feelings and emotions are an important part of their decision-making process. As Daniel Kahneman, a Nobel Prize winner in economics highlighted in his book "Thinking, Fast and Slow," we often make decisions based on our emotions and then find a way to rationalize our decision. In the B2B market, not all buying decisions are made based on a rational analysis of how a product or service will help the company. Far from it. Since people buy products and services for their organizations, their individual needs must be addressed as well. Buying on behalf of your organization can be stressful and anxiety-provoking. Research shows that second-guessing occurs in more than 40% of completed B2B purchases (Harvard Business Review).

In part two, we cover the nine elements of an ideal customer profile. In part three, we describe how to structure your customer knowledge and use it to create an effective marketing playbook and go-to-market strategy. In part four, we explain how to get this information from customer interviews and surveys, and by shadowing sales calls and monitoring how customers use your product or service.

Now, let's start understanding your customers.

Part 2: The Nine Elements of An Ideal Customer Profile

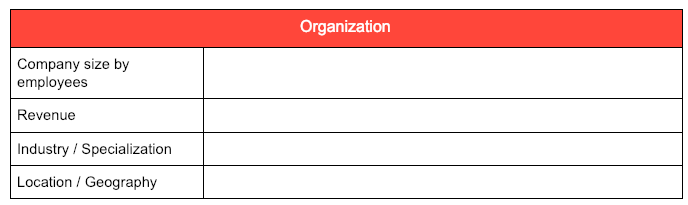

1.Target Organization

You need to zero in on the size of the organization you sell to. In smaller companies, the decision making is concentrated in fewer people. The budgets are smaller. Executives can only focus on a small number of top priorities and pains.

In larger organizations, decision-making is spread across many departments and managers. Typically the sales cycle is longer because multiple stakeholders in the organization influence the buying decision. Budgets tend to be higher.

You might have a good idea of the roles and titles of the folks most likely to buy and/or use your product or service. For instance, let’s say your target users are marketing VPs. No two marketing VPs face the same set of problems and chase the same goals. These problems and goals can vary greatly depending on the size, revenue, and industry of the company.

Ask two marketing managers with the same exact title what they do, and you may be surprised at how differently they answer. People with the same job titles can have completely different responsibilities, goals, metrics, teams, and budgets. At the same time, people with completely different titles can have the same responsibilities.

For example, a VP of Marketing at a small bootstrapped startup often handles virtually everything related to marketing, from content creation, nurturing emails, and website updates to PR and paid ads. Publishing great content consistently is a challenge for a small startup.

A VP of Marketing for an organization with over 500 employees worries less about content creation because, in addition to a significant budget, he probably has a team dedicated to content marketing. A more pressing concern for this VP might be driving leads from bigger companies with bigger budgets.

Start your customer profile analysis with an overview of the organizations where your current customers operate, including:

a) Company size by employees

b) Company revenue

c) Industry or vertical

d) Geography

Consider analyzing your current customers, as well as some of your potential customers. More on this later.

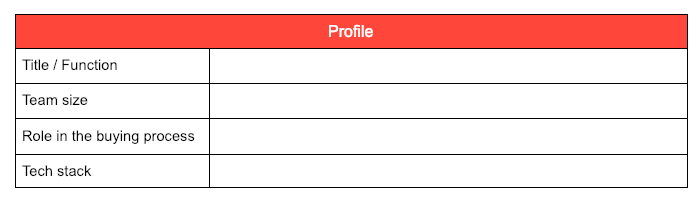

2. Customer Demographics

Now we need to look more closely at the specific people within your target organizations, including those who make buying decisions and the folks who will use the technology.

It's worth mentioning that in B2B sales, you often deal with multiple stakeholders. While your ideal prospect is typically an economic buyer (often the decision-maker) or an end-user, other influencers can either prevent or facilitate the purchase.

Outline and build profiles for everyone in the organization that will be impacted by your product or service. Start with profiles of the decision-makers and end-users.

a) Title: Note the typical job title of the decision-makers and end-users.

b) Function: Indicate the organizational function the decision-makers and end-users usually occupy or manage.

c) Team size: Estimate the size of the decision maker’s and end user's teams and the number of direct reports.

d) Role in the buying process: Note their role in the buying process (e.g., decision-maker or economic buyer, end-user, influencer)

e) Tech stack: List the set of technologies your customers typically use.

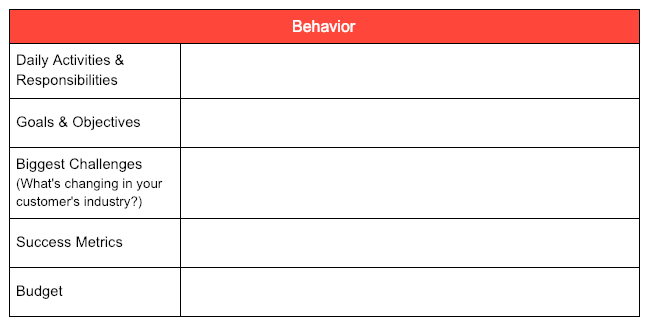

3. A Day In The Life of Your Customer

Now that you have a rough picture of your target customer and their organization, it’s time to dig deeper into their average day. This includes observing and understanding their normal activities and responsibilities, as well as their goals and challenges.

Many marketers and sales professionals overlook this step. However, by understanding how your customers manage their days, you can uncover ways to improve their lives and identify what features to build in your next release. Don't expect the customer to tell you what is the biggest problem for them and how they need it solved. As Henry Ford once said: “If I had asked people what they wanted, they would have said faster horses.”

It rarely happens that way. You should take clues from how they operate and then figure out a way to solve the problems you see. Often customers habitually do things a certain way without seeing a problem in their process.

Remember that a customer’s problems are always contextual. Understanding that context means you can:

- Build products and services that provide richer value to your customers and fit more easily into their daily flow.

- Overcome more objections to your product

Knowing what a day in the life of your customers looks like might uncover ideas for new product features that will help you expand your customer base or even penetrate new markets. The two most common ways to expand your offering are horizontal and vertical expansion. Horizontal product expansion means expanding your current product or service capabilities or building new products or services for other vertical and industries. Vertical expansion is building more features for your current customers and the industry (or industries) you target.

One can argue that vertical expansion is a more efficient and effective way to grow because you are solving additional pains for your existing customers. This way your offering becomes indispensable and very difficult for competitors to displace. Plus, building new capabilities for existing customers is also more efficient in terms of customer acquisition costs. It's always cheaper to sell to a customer that already knows your company and uses your product or service. Finally, positioning your product or service as a niche solution for a specific customer or industry is a great way to differentiate.

The figure below is a classic breakdown of horizontal versus vertical solutions.

Let's take a CRM solution as an example. Salesforce is a typical horizontal solution -- the CRM system for any industry and any size company. In a mature market, the industry leader’s offering is usually broad enough to cover many industries. But if you were to launch a CRM solution today, a vertical approach might be a better way to differentiate. Veeva CRM is a great example of a vertical solution that solves problems for a specific industry: pharmaceutical and life sciences.

How is this related to your customers’ daily activities? As you understand how your customers spend their day, you can identify additional problems and inconveniences that you can solve.

To fully understand your customers, consider doing a mix of forms, interviews, and job shadowing. There’s no better way to understand a person’s day than to sit by their side while they’re at work. What problems do they experience that they take for granted? What’s a meaningful part of their job that they’d never think to mention?

Daily Activities and Responsibilities

Outline all the daily activities of your target customers. Don't focus only on the processes that your product improves. Instead, draw a high-level picture of everything they have to deal with on the job.

Pay attention to the specific tasks or duties your customers are expected to complete as a function of their roles. A customer’s responsibilities can give you a better sense of what their day-to-day looks like as well as the challenges they are likely to face.

Goals / Objectives

It's crucial to know your customers’ goals and objectives. These can include micro- and macro-level goals that impact the company on many levels. For instance, if you’re targeting customers in senior roles, their goals will likely be tied to business outcomes such as revenue, efficiency, market share, and so on. They may also have personal goals, such as reducing the amount of time they spend in company meetings. Be sure to include monthly, quarterly and annual goals.

Big Challenges

Once you understand your customer’s goals, it’s crucial to understand the biggest challenges that get in the way of achieving them. This is what your product attempts to solve. Ask what problems they experience that they take for granted.

Success Metrics

Success metrics depict how a person or team measures success. For a VP of Marketing, success metrics could be leads generated, the number of product signups, contribution to revenues, or reducing the cost per signup or customer acquisition cost.

Budget

Understanding your customer’s budget tells you the financial resources at their disposal. The bigger the budget, the higher the probability a person will spend money on a solution that helps solve a problem quickly and efficiently, rather than try solving it internally.

4. Environmental or External Market Forces

As you learn about your target organizations, buyers and end-users, it’s helpful to evaluate the market conditions and trends that bring changes from outside the company. No company operates in isolation. A market is a powerful force that can bring tectonic shifts to the industry. Consider just a few game-changing market shifts: the internet, smartphones, 3G/4G/5G, and blockchain.

Oren Klaff, the author of “Pitch Anything,” identifies three major forces that impact a market: economic, technology, and social. It's part of your job to be aware of and, in some cases, educate your customers on the economic, technology, and social forces that can drastically change their lives.

Economic Forces: These include what’s happening in the customers’ countries, industries, and markets, and even global economic conditions. Your customers’ buying decisions might be impacted by things like inflation and interest rates.

Technology Forces: Technology trends situate your offering in the market and will heavily influence a company’s perspective on what investments they’re interested in making. If everything is moving to the cloud, a company may be less likely to purchase a solution that requires server-side installation, for example.

Social Forces: What is changing in terms of user behavior and expectations? For instance, today’s customers expect 24/7 service and more personalized user experience.

Not only is it helpful to understand the external forces impacting your target customer, but Klaff suggests using these forces to contextualize your offering. Show how your products or services follow and keep pace with these external forces.

We have witnessed a few market forces in the SaaS industry over the last decade. The competition in SaaS is brutal, driving the cost for software down. It is an economic force that impacts everyone in the technology industry.

5. Customer Acquisition Process: How Your Customers Buy

It's not enough to make your customers want your product or service. You have to make your offering easy to buy. Designing a frictionless buying experience is as important as designing the product or service itself. The easier it is for a customer to buy your product or service, the more satisfied they are with your company and offering.

This is why retail stores are not only concerned about their product selection and quality, but also their store layout. Is it easy for people to walk in? How do you position merchandise around the store so customers easily find what they want?

Amazon provides great selections, low prices, and quick shipping, and also allows customers to quickly and easily compare and buy products.

In the pre-SaaS era, buying on-premises solutions was difficult because your organization couldn't try or test the product before purchasing it. An on-premise product often required software installation on a server. Multiple members from the seller and buyer organizations had to be involved to coordinate product implementation, customer onboarding, and training.

The SaaS model changed everything. With cloud-first solutions, it became easier to offer free trials and even to launch freemium customer acquisition models. Today, tons of companies let you try their product or service before the purchase. Some even provide a freemium version to reduce all the barriers people face when trying to experience their offering. SaaS has shifted the sales process from a top-down approach (selling to top executives) to a bottom-up approach (getting buy-in from many individual end-users and then securing C-level approval).

Before designing a buying process for your customers, your team should learn how your customers purchase similar products. Your team can get this information by asking prospects how they would go about this and by interviewing current customers to understand how they made their buying decision.

The way a customer buys is an essential part of the overall customer experience. Imagine if you had to submit a form and then wait for a salesperson to show you a demo before you could purchase Slack. It's a ridiculous process and it would have prevented Slack from growing so quickly. Anyone can log in to try Slack. The company removed much friction from the buying process.

Slack is a relatively simple SaaS solution, which makes the buying process fairly simple. But even a more complex buying process could be optimized by understanding how organizations buy. When you are selling to a larger organization, you can almost always shorten your sales cycle by providing your buyer champion with content that helps him guide the purchase through multiple stakeholders in his organization.

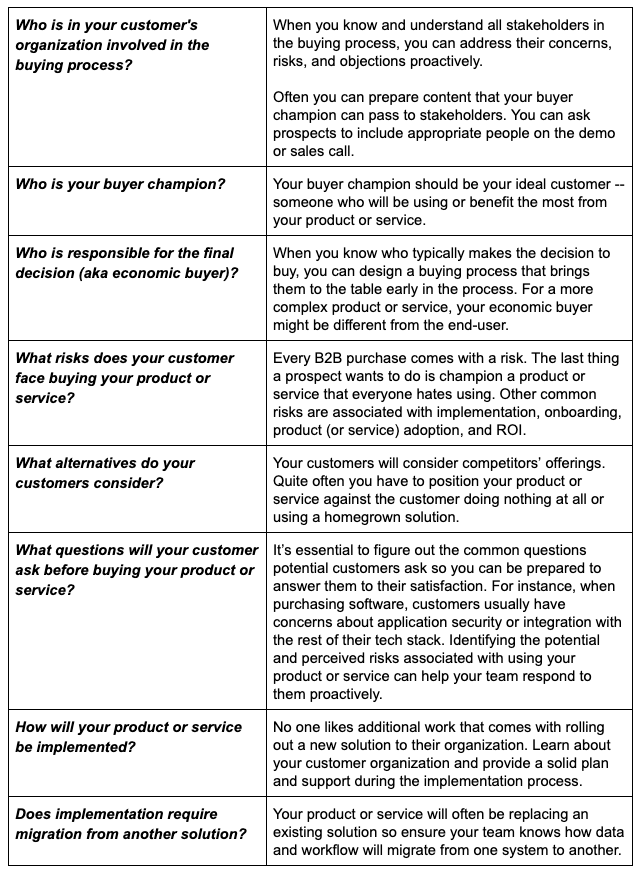

Answering the questions below will help you understand how customers buy from you.

Let's be clear, the customer acquisition process doesn't end when a customer signs the contract. You should analyze the buying process starting with how your prospects identify their pain and start researching options and continue through the time they are using your offering and possibly making follow-on purchases. Before the purchase, you need to sell prospects on the values and needs that your product or service solves. After the purchase, you have to reduce friction when it comes to implementation, onboarding, and adoption.

After your customers buy, they need to implement your product or service. Your company needs an implementation plan for more complex solutions or a customer onboarding process for simpler solutions. You want to design for the Aha moment that delivers initial value. The Aha moment answers the question: how will the customer experience the first value?

Your ideal customer profile won't be complete without a clear understanding of how your customers buy your product or service. As you learn how your typical customer buys, you can create a buying process that improves the experience and accelerates the buying decision. Your team can anticipate roadblocks and proactively address them.

Sales teams can be trained to ask appropriate questions that will help them deliver a better buying experience. Marketing teams can create content to address typical objections, implementation concerns, or risks associated with buying and using your product or service. Development teams can design better onboarding processes that are aligned with how customers buy. And customer success teams can train customers on using the product or service.

As you create your ideal customer profile (ICP), spend time researching how your customers buy. It will help you design better buying experiences and improve the overall customer experience.

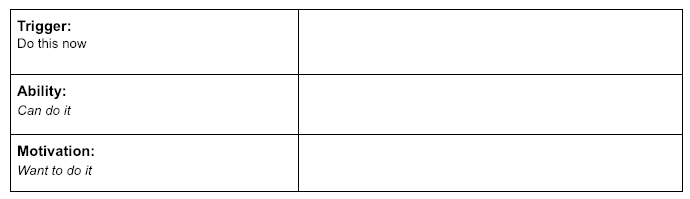

According to the Fogg Behavior Model, in order for a sale to take place, the customer needs the motivation and ability to buy, as well as a prompt. And all three elements need to be in place at the same time.

It’s important to understand both what motivates and enables someone to make a purchase and to use this information to provide an effective prompt or trigger to make the sale.

Motivation:

- What will they research when they have a need for your product or service?

- What questions will your potential customers have before they even know they need your product?

- What objections do they have to your product?

Ability:

Does your target customer have the authority to make a purchase under a certain price point? For more expensive or complicated products, there are often multiple stakeholders and approval steps.

- What buying power does your target customer have?

- What information do they need to get the sale approved?

6. Pains & Problems vs. Values

The greater the pain that buyers experience, the more motivated they are to find a solution. We can all relate to instances in our work environment where the problem was unbearable and the solution was urgently needed. In such times, we search the internet, ask our peers for a recommendation or recall brands and products that can help us solve our critical issue.

Principle #4: Sell the pain, not a solution.

That's why when the pain that you are solving for buyers is big enough, the selling process is inherently easier. It comes down to showing buyers that your company is the expert on this topic and that your approach and solution is the one that will best satisfy their needs.

When the problem isn't obvious or isn't painful enough, the sales process becomes more complicated because you have to sell the problem first. You have to show buyers that the problem is severe, urgent, or frequent enough to address it.

Always sell the pain and not a product. Theodore Levitt, Harvard Business School professor and the author of Marketing Imagination, said: “People don't want to buy a quarter-inch drill, they want to buy a quarter-inch hole!” If the problem is known and severe then selling a solution becomes much easier. When the prospective customer is not aware of the problem and doesn't view it an impactful or high on the priority list, selling the problem becomes the main aspect of the sales process.

When you are selling the problem, you as an individual and your organization as a whole become more empathetic to your customers. Buyers don't see your salespeople as pushy but as helpful guides that really care about their success. The products and solutions that you offer just happen to assist them in that process.

The Challenger Sales methodology is built around the idea of challenging customers, their assumptions, and their decisions. We often forget that the more effective strategy is to challenge buyers on problems and pains rather than on product-related topics. The best organizations challenge buyers to do things differently and to address their problems and pains by embracing a different process or approach. In such instances, buyers view salespeople as more authentic and invested in their success. Challenge your buyers on how they understand their problems and how they approach solving them.

What differentiates an ideal customer from a potential customer is the severity and awareness of the problem that you can solve for them. As you research and create your ideal customer profile, closely examine all customer pains and get as much context for the problems that you want to address. Companies must understand customer pains and problems in terms of awareness, urgency, severity, and frequency. A deep analysis of your customers’ problems provides an unparalleled context of customer decision-making.

The context is as important as the problem itself. In some cases, the context can change the problem completely. We won't see the context of the pain without analyzing the customer and company profile, and understanding the customer’s typical day, how they and their organization buy, and what they say, feel, think, and do. Everything that we talked about so far when it comes to understanding your customers was done to build that context.

Let's go back to the earlier example of buying a couch. When a potential customer walks into a furniture store and expresses the need to purchase a couch, it is fairly easy for salespeople to identify the pain the person is trying to solve and value the buyer will get from a product. In simple terms, the customer needs a place to sit and hang out while reading a book, watching TV, or hosting people. At the same time, a well-designed couch can improve a room’s aesthetic appearance and provide a sense of comfort. The need, pain, and value are somewhat clear. What's easy to overlook is the context in which the potential customer’s pain exists and how that impacts the decision-making process.

In this example, let’s say the person is buying a couch for the living room or for a home theater. A couch in the living room can be smaller and more aesthetically pleasing, while the biggest priority for the couch in the home theater is comfort level rather than size or color. Furthermore, the size and brightness of the room are important buying considerations. And what about other furniture in the room and the color of the walls -- don't those matters too? The answers to these questions provide additional context and enable salespeople to come up with a better solution. This explains why interior designers are paid more than sales associates at the furniture outlet departments. Their job is to understand the context in which customers make decisions.

What differentiates great salespeople from good ones is how they understand the context in which the potential customer makes their decisions. The only way to understand the context is to ask calibrated questions to learn every single aspect of the problem the buyer is trying to solve. A great salesperson asks questions to understand the context of the pain and then suggests the optimal solution.

The context in which customers make decisions has a tremendous impact on B2B sales too.

Case Study: Can onboarding solve a bad product design?

A few years ago, I was helping an early-stage startup (myTips.co) that built a product to help companies design an effective onboarding process by guiding users with in-apps pop-ups and product wizards. The company had a working product and I was helping the founders build sales and marketing campaigns to sign their first 20 customers. We targeted companies that had already experienced the pain of ineffective user onboarding.

As we developed our outbound sales campaign, discovery questions, and demo scripts, we realized the pain of onboarding wasn't felt equally across market verticals. It wasn't enough to find a company that experiences difficulty guiding users to their first Aha experience. It wasn't enough for us to diagnose customer pains.

We soon realized that predicting how likely a buyer would be to try our product depended on the technology they used to build their products. An even more interesting realization was that often our ideal customers (companies that most feel the pain of poor onboarding) tried to fix bad product design with onboarding. So, ineffective onboarding was baked into a far-from-ideal product flow and design.

These problems won't be completely eliminated with a third-party onboarding solution. Sometimes we challenged buyers to change part of their product design before implementing our onboarding solution. We understood the context of the problem and challenged potential customers to approach this problem differently, even if it meant using less of our product.

What's more, even for companies that could benefit from an onboarding solution, we had to assess the user intention. For example, while new users might appreciate a pop-up directing them to the next step, returning users might find this an annoying distraction that slows them down. Context matters.

The startup was shut down. The main lesson was that not all pains and problems can be solved with outside products. You can't solve a bad-product problem for other organizations. You can assist companies in building a great product, but you can't build it for them. A great product (or service) is the core for the survival of every organization.

6.1. Awareness vs. Urgency

The goal should be to learn everything about your potential customers and their pains and problems. That means collecting and documenting the pains and problems that your product or service isn't solving. This provides the context for how the pain you are solving fits with other priorities. As you learn from your customers and their problems, analyze how the pain you are solving fits in the context of everything else your customer has to deal with.

Is your potential customer aware of the problem that your product solves? If so, what do they do about it now? Those are the main questions that you will have to answer while creating an ideal customer profile (ICP). In his book “Startup Manual,” Steve Blank categorizes customer problems into four groups.

Active Problem: Potential customers recognize a problem or passion and are searching for a solution but haven't done any serious work to solve the problem.

That's a dream scenario for every company Potential customers are aware of the problem and are actively looking to solve it. It's an ideal scenario because you don't have to educate the buyer or sell him/her on the problem. You just underscore the problem and show how your product solves it and the potential customer is ready to buy.

Passive Problem: Potential customers know of the problem but aren't motivated or aware of the opportunity to change.

In this case, you have to figure out why the potential customer has done nothing to address this problem. It could be that the problem isn't big enough or isn't big enough compared to other priorities. In this case, you must show that by not addressing this problem, the potential customer is falling behind. What are the risks of not solving this problem? Educate your potential customers on the impact of the negative outcome on them and their organization, and how a positive resolution to the problem will improve their life.

A buyer sees the problem as passive if the consequences of not solving it are lower than the perceived effort to solve it.

Vision: Potential customers have an idea for solving the problem and even have cobbled together a home-grown solution, but are prepared to pay for a better one.

The vision problem somewhat relates to the active problem. The only difference: For an active problem, prospective customers search for a third-party solution, while for a vision problem, they consider ways to solve the problem on their own. It's much tougher to sell a solution to a problem when an organization is already building its own internal solution. Resources -- including people’s efforts and time -- were involved and no one likes to see their project abandoned.

Latent Problem: Potential customers have a problem but don't know it.

Latent problems are the hardest to attack because they require educating the market and your target customers about the problem. However, some of the most iconic companies were built to solve problems that no one was looking to solve. Prior to Google, we weren't looking for a better search engine. We weren't aware that we weren't connected so well before Facebook came along. Most of the earliest Salesforce customers weren't aware that you could run CRM in the cloud.

The urgency is another important factor when evaluating customer pains. Obviously, organizations find it more urgent to solve vision and active problems than passive and latent problems.

So, how do you identify the urgency of any problem? After I conducted a few dozen customer interviews, it became clear that it’s of little value to directly ask customers whether they view a problem as urgent or not. The more effective approach is to ask how this particular problem fits into their current priorities. That’s why I advocate first asking broad questions about all types and kinds of problems your potential and existing customers face, and then asking them to prioritize these pains.

Knowing your customers’ “day in the life” from different angles and learning about all kinds of problems helps you better understand your customers and allows you to position the problem you are solving for them in context. Simply put, you will know how the problem you are solving fits with other priorities.

6.2. Frequency vs. Severity (or Impact)

One way to determine the problem that your solution solves is to analyze the frequency and severity of the pain. As you research your customers and create your ideal customer profile, list all the pains that your customers experience.

In my experience, it helps to record all the pains that your customers experience even if your solution doesn't solve them all. Analyzing related pains can give your new product and feature ideas as well as provide context.

Frequency

- How often do prospective customers experience this pain?

- How often does this problem occur?

Some pains occur more regularly than others. For example, buying a car or a house isn't a frequent event. Similarly, finding new office space for your organization isn't something that happens often.

On the other hand, we often cook meals at home, making it a high-frequency pain for anyone who doesn’t like to cook. Salespeople need to send proposals and contracts to close deals so this constitutes a high-frequency pain.

Severity (or Impact)

- How severe (i.e., big) is this pain or problem for a customer?

- How does this pain fit with customers’ other priorities?

Buying a car or a house might not happen frequently but it's a big pain. Think about researching and deciding on the car brand, comparing pricing, choosing a finance and payment option. On the other hand, cooking at home might not be a big deal if you like to cook or you can afford the alternative solution to going out.

In business, a data breach is severe pain with many negative consequences. So, even though this a rare event, companies want to avoid it all costs because the impact is incredibly high.

Here are examples of various problems in terms of frequency and severity:

Frequent and severe

- Managing the sales process and customers

Frequent but not severe

- Managing docs remotely

- Team communication

Severe but not frequent

- Office relocation

- Event organizing

- Data breach

Principle #5: The bigger the pain you are solving for the potential customer, the easier it is to sell a solution.

6.3. The Villain or The Enemy

Listen carefully to your prospective and existing customers and you’ll hear what prevents them from reaching their goals. Every new technology or product has an enemy. The enemy could be a process, product, or some other factor that prevents that person -- or someone within their organization -- from reaching their goals. As you learn more about your ideal customer, outline not just pains and goals but processes, products, and technologies that prevent them from reaching their goals. The enemy or the villain will be part of the story that you will create for your marketing campaigns and content and sales conversations with prospects. Let's examine a few examples of how companies selected an enemy and positioned against it.

The most famous and classic example is Salesforce. In the early days of Salesforce, Marc Benioff staged fake protests featuring the slogan "No Software." Salesforce pioneered the software-as-a-service (SaaS) wave replacing big and clunky on-premise CRM with a cloud-based solution. "No software" was a great slogan and a great enemy to use in a corporate story. That’s because it positioned Salesforce not against a particular company but against traditional on-premise solutions that dominated in the early 2000s. The story was the perfect backdrop for the “hero” of cloud-based solutions that are cheaper, more effective, and more efficient.

Slack is another example of a company that positioned its brand well against the enemy. During a PR blitz, Stewart Butterfield, founder and CEO of Slack, actively positioned the product against email. Multiple articles expressed the view that Slack is an email killer. While I don't think it's accurate to say anything can replace email permanently, it was a clever marketing tactic and positioning that in a sense “forced” people to choose between Slack and email.

Other examples include Drift positioning itself as an “anti-lead form” company. Metadata positions itself against A/B testing, highlighting that companies need multivariate testing to quickly find the combination of elements that perform best when it comes to online advertisements.

Why is this relevant to creating an ideal customer profile? The more we interact with our customers, the more we hear about their pains and concerns. Understanding what prevents prospective customers from reaching their goals can lead you to an effective marketing positioning strategy. Start thinking about it early when you talk to your prospects and customers.

6.4. Business vs. Personal Values

Many B2B buying decisions are complex. On the one hand, your product or service has to solve real problems for an organization. On the other, it has to fulfill the personal needs of the people involved in the buying process. It gets even more complex when you realize there are multiple people involved in the buying decision and their personal needs are usually different.

As individuals, we are exposed to many tech products and services in our personal lives. Consumer companies are much better at driving great customer experience and building products we love to use. In fact, the consumer market drives our expectations when it comes to business purchases. We can't easily switch off our high expectations in a work-related environment. Nor should we. Our personal expectations and preferences impact how we evaluate products and services for our companies.

How can we build solutions that address organizational needs as well as fulfill individual values? That's what differentiates iconic B2B companies from everyone else.

In my consulting work, I have the unique opportunity to look inside many organizations. What I’ve noticed is that B2B companies often communicate strikingly similar values to prospective customers: easy to use, time savings, reduce costs, grow revenue, decrease risks and so on. Some variation of these values is communicated by almost every B2B company. What's rare is to see a company proactively addressing the needs of individuals within an organization.

The most helpful work on the intersection of business and individual values in B2B markets comes from research conducted by Bain & Company. In an HBR article, Eric Almquist, Jamie Cleghorn, and Lori Sherer summarize and categorize 40 distinct values in B2B offerings, categorized in 5 levels.

This values pyramid helps to understand how B2B offerings can fulfill both objective organizational values as well as individual and personal values. When designing an ideal customer profile, you want to outline how customers perceive both their business and personal values. Listen carefully to how they describe the benefits that your product or service provides and what they get out of it beyond features and functionality.

Business values are easy to evaluate because they are often based on metrics, somewhat objective reasoning and logic. Personal values are much harder to pinpoint and communicate. That's why you need to develop empathy for your customers.

7. Empathy: What Customers Say, Think, Feel, and Do

Often we view the B2B sales process as a cold analysis of customer pains, values, and goals. We forget that people buy business products. And whenever people are involved, we will be dealing with feelings and emotions that drive buying decisions. We are not as rational as we believe when it comes to making decisions (for more on this, check out the great book, “Predictably Irrational” by Dan Ariely).

Empathy helps build trust with your customers. It shows that your goal isn't just to sell something but to truly improve their lives. As you create your ideal customer profile, understand what your customers say, think, feel, and do in order to develop that empathy. Understanding what they say, think, feel and do helps you figure out how to motivate them to take action/make a purchase.

In the last few years, I have conducted hundreds of customer interviews. In some cases, I use customer interviews as due diligence when starting up with a new client. Other times, I conduct customer interviews while researching product ideas for my own startup. Over time, I realized that the key to a successful customer interview is a balance. You want to ask open-ended questions that let the customer wander in directions that you otherwise wouldn't have considered while guiding them into areas where you want to focus.

After conducting hundreds of interviews, it became apparent to me that you can't blindly trust what customers say. You need to hear how they feel, what they do, and how they think. Don't expect them to tell you the solution to their problems. Instead, be keen on noting subtle feelings and thoughts that paint a clearer picture of their situation and day-to-day activities. As Seth Stephens-Davidowitz made crystal clear in his book “Everybody Lies,” people tend to misrepresent and misreport when asked directly. In other words, often what we say and what we do aren't in sync.

My journey to finding a systematic approach for learning about customer feelings led me to discover the empathy map that designers and UX/UI researchers use to get customer feedback. The most sophisticated product teams regularly show customers new product features and updates before release and use an empathy map to sort their feedback. Startups can use this process of showing and testing product features before developing them.

Customer development is not only for startups. Even established companies will benefit from showing and discussing product releases and features prior to committing great resources to build them. The customer development process never stops. Creating an ideal customer profile and conducting a customer discovery process are two sides of the same coin.

As you conduct your customer development and gather feedback, you refine your understanding of the ideal customer profile. At the same time, as you research your ideal customers, you find better ideas and strategies to improve your product and conduct customer development.

Here are a few questions to help you get started with an empathy map:

- What is the customer thinking and feeling? What are some of their worries and aspirations?

- What would their friends, colleagues, and boss be likely to say while the user is using our product? What would the customer hear in these scenarios?

- What would the user see while using our product in their environment?

- What might the user be saying and/or doing while using our product? How would that change in a public or private setting?

- What are some of the user’s pain points or fears when using our product?

- What gains might the user experience when using our product?

Note: Here are good articles to help you better understand empathy mapping:

- Empathy Mapping: The First Step in Design Thinking;

- Empathy Map – Why and How to Use It;

- Agile Coaching Tip: What Is an Empathy Map?.

Your product and brand should strive to change how people feel about their responsibilities and themselves. As I discuss later, designing your product or service to evoke feelings is a powerful way to connect with your customers. You first want to pinpoint how your customers feel about the current broken or complicated process or unsolved problem. Then you want to figure out what they will feel after solving these pains -- including how they will feel about themselves afterward.

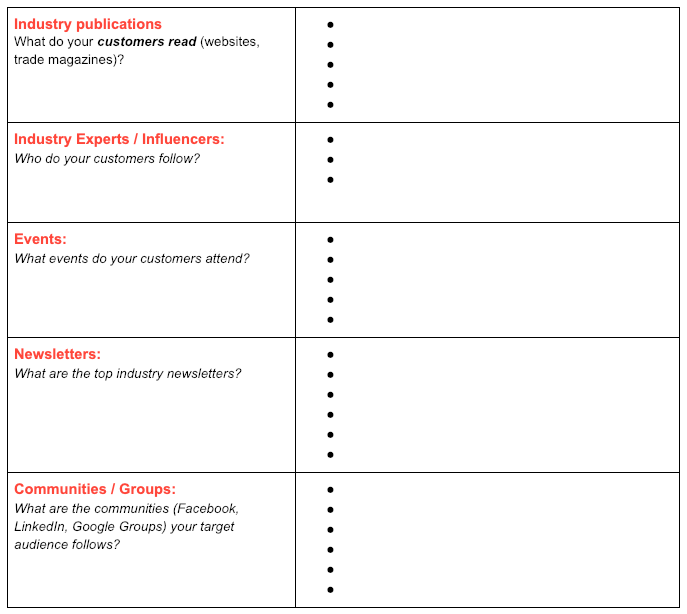

8. Read, Attend, and Follow

We form our opinions partially from experience and partially from internalizing industry knowledge that's accessible to us. Part of knowing your customers is understanding where they get their information. The resources that drive shared industry knowledge will help you better understand your customers’ top-of-mind issues and the trends that matter to them.

Learn what your customers read. As you develop an understanding of your customers’ problems, reading related industry articles allows you to see how these pains and problems are described and the recommended solutions. Creating a list of industry publications not only helps you better know your customers, but it also allows you to develop a comprehensive content strategy. You can pitch articles to these publications and build relationships with writers. Build strong enough relationships and you can even ask them to review and share your content if it fits the narrative.

Identify industry experts. Reviewing industry publications also helps you identify who is driving the prevailing industry view and who attracts the most respect and share of voice in the community. These thought leaders can amplify your content reach and even review and recommend your product. Making them care about your message, the pains that you solve, and your view on the industry goes a long way to helping you build momentum around your story.

Drift is a great example of a company that used this strategy to build community buzz. They reached out to top marketing and sales executives that speak at industry events and convinced them to try Drift. These influencers liked it. Drift offered some of them an advisory stake, invited them to speak at their conference, and started promoting their content. In turn, these influencers started to promote Drift to their followers and network. This is a brilliant strategy.

Events such as conferences and user groups provide an opportunity to speak directly with many target customers in a short period of time. There is no need to set up customer calls for a few weeks to interview ten, twenty, thirty customers. You can do it in the span of one event.

Email newsletters are underrated. Email is not dead and you shouldn't expect it to go away. Just as TV did not replace radio, the Internet did not replace TV, and nothing -- not even Slack --. will completely replace email. Read the email newsletters that your customers subscribe to. As with publications, newsletters are a great way to “eavesdrop” on the content that your customers consume.

Online and offline communities are an important source of information. Communities allow you to tap into a highly concentrated gathering of your target customers. Look at communities and groups associated with top social media networks: Facebook, LinkedIn, and Reddit.

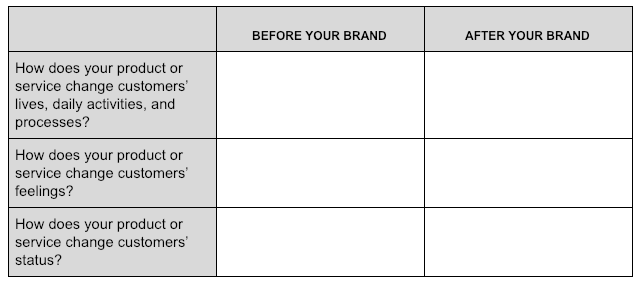

9. Who Do You Want Your Customers to Become?

The purpose of every company is to create customers, as Peter Drucker once said. Notice, he said "create" customers, not identify or find. Great companies do not just solve customer pains, but also change how their customers think, what they do, and how they feel. Successful products significantly change people’s lives in a meaningful way.

The best way to create a customer and change their life is to be future-thinking. Michael Schrage, a research fellow at MIT Sloan School’s Center for Digital Business, wrote for the Harvard Business Review, “The better we know and understand who customers want to become, the better we can invest and develop the innovations necessary to get them there.”

This future-perspective isn’t just about building better products, it’s also about creating better messages. You need to be able to describe the vision and the promised land for customers so that they can join you there.

Product design and sales teams can be short-sighted when they focus too heavily on a customers’ current problem and ignore their long-term goals. Can you help them achieve these goals? You can think as idealistically as you want as long as you have practical messaging, real data, and real solutions to back up your claims.

As you research your ideal customers, outline exactly how you want them to act, think, and feel like your customers. How do you want to change their lives? How will their lives change because of your product or service? How will the actions of your customers change with your product or service?

Part 3: Integrating the ICP Into Your Marketing and Sales Strategy

The nine steps of creating an ideal customer profile are designed to help you figure out the right customer for your organization.

You have interviewed your prospective and existing customers, collected the data, and now understand the context in which your customers make decisions. The next step is to analyze and integrate the information about your customers with your go-to-market strategy. As you create your ideal customer profile you want to document this knowledge in a way that enables you to share it across your organization. Your ICP profile document can be the place that summarizes everything that you know about your customers. A newly hired employee can start their onboarding by reading about your organization’s customers. Your marketing team can use the ICP to guide their decisions about campaigns and content. Your sales team can use the ICP to better understand the most compelling ways to engage and motivate buyers to purchase.

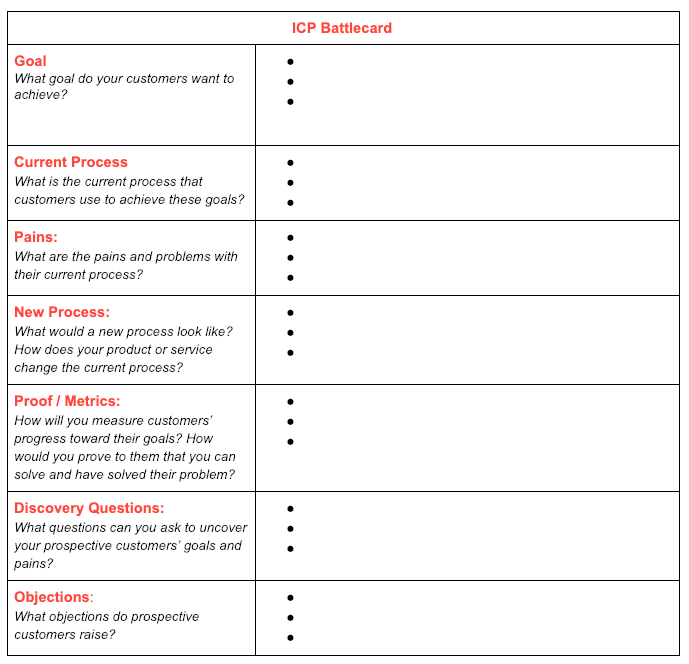

In order to integrate an ICP into your marketing and sales playbook, structure your customers’ pains, goals, and processes in meaningful groups based on the pains that you solve and the goals you enable your customers to reach. Use the framework below for each customer goal and pain.

Goals

First, outline the goal(s) that your customers are trying to achieve. It should be easy to do once you’ve gone through your ICP research. Write down one goal that you can help your customers reach.

Current process

Next outline the process that your customers currently take to achieve this goal. Outline this process in step-by-step detail. By doing this, you might learn something new or better understand why this process is so complicated today.

Pains / problems

The next step is to write down the pains associated with the current process or achieving goals. Now, you have a clear picture of goals, your customers’ current process, and pains that could be associated with goals and current processes.

New process (using your product or service)

Write a step-by-step outline of the process when customers use your product or service. Does it take fewer steps now? Does it require customers to completely change their process?

Proof/metrics

List metrics that your organization will use to show new customers that you can get them closer to their goal or proof that you can substantially decrease or completely solve their pain.

Discovery questions

Now that you know what problems you are solving for your customers and what goals you can help them achieve, create a list of discovery questions. These are intended to help your sales and marketing teams zero in on the most promising buyers early in the buying process. Discovery questions will help your organization create a scalable and predictable sales process. Your sales reps will be focused on understanding customer pains early in the qualification stage and structure their calls, demos, and presentations directly around a specific goal and/or pain.

Objections

Handling customer objections is part of the sales process and every organization has to be ready to tackle them. Sales representatives should be collecting objections they hear from prospective customers. Over time, you will create a common list of objections that you have to address over and over. Write your responses to each objection. This way your sales team addresses them consistently. At the same time, your marketing team should create content that addresses these objections proactively.

Repeat this process for each important customer goal and pain. This will give you a blueprint of how to personalize your marketing and sales approach in line with individual customer goals and needs.

Part 4: How To Gather Info About Your ICP

Now, let's get into how you gather all this information about your target audience to create an ideal customer profile. When I was writing this article, I made the conscious choice to start with the key elements of an ICP. I believe that knowing what you are looking to get out of the process makes it easier to structure the details. Now we know what we want to learn from our current and potential customers, it is easier for us to figure out the right questions to ask.

You can learn about your customers in multiple ways: Some are direct, such as interviewing people, while others are indirect, such as reading industry news. That said, when it comes to understanding people, nothing beats face-to-face interaction. You can pick up many valuable clues by noticing facial expressions and gestures.

The four methods of customer research

That's why face-to-face interviews are by far the best way to learn from your customers. This method is especially helpful in building empathy based on how your customers feel and think. Facial expressions are very telling and humans are wired to interpret them. Field studies fall into this category. Field studies are conducted in the customer's location and context. Your organization can learn a great deal and pick up nuances by leaving the office and observing people as they use your product or service.

The second best option is videoconferencing. This method allows you to see the person you are interviewing and notice all the non-verbal clues. It is also a more efficient way of interviewing your customers. Both interviewees and interviewers will save tremendous time by avoiding any need to travel. Plus, it’s often not an option to meet customers in person (such as when they are in different geography). Videoconferencing is probably the best option from an effectiveness and efficiency standpoint.

You might have guessed that a phone call or voice conference is the next best option. This is the easiest and probably the most popular method of interviewing. Whenever videoconferencing is slowed down by your internet connection, fall back on this option.

Quantitative surveys can scale your customer research since it is a lower investment on the customer side to answer a survey than to spend twenty or thirty minutes on a call. But there are a few critical caveats. You have to design your survey questions to eliminate bias. In other words, you don’t want to ask leading questions that push people to give the desired answer. Also, surveys are limited when it comes to uncovering new information. Since you have to create questions before you distribute the survey, you can only ask about topics that you already know about.

The best strategy is to start your research is via direct conversations with your prospects and customers. The conversation format allows you to ask open-ended and follow-up questions. As you learn more about your customers, you can then structure create a survey to test how your hypothesis applies to a broader market. In other words, learn the unknowns through customer conversations and then use this knowledge to create a customer survey.

Customers vs Prospects

The question that's often raised is whether a company needs to focus on interviewing current customers or someone who isn't yet a customer. For early-stage companies, the process of finding ideal buyers and acquiring customers overlaps with creating an ICP.

Customer development is a four-step framework developed by serial entrepreneur and business school Professor Steve Blank for discovering and validating the right market for your idea, building the right product features that solve customers’ needs, testing the correct model and tactics for acquiring and converting customers, and deploying the right organization and resources to scale the business. In other words, customer development is the process of finding your first customers. As a company finds its first customers, it starts to better understand its ideal customer profile.

Ideally, a company wants to learn from both current and potential customers. If your organization has existing customers, start your research there. When looking at current customers, focus on customer segments that are the most profitable when it comes to customer acquisition cost (CAC) vs. customer lifetime value (CLV) ratio. Analyze which customer segments yield the highest average selling prices, customer lifetime value, and lowest churn.

That said, your customer research won't be complete and comprehensive if it doesn't include conversations with people that might be a good fit but are not yet your customers. Talking only to current customers increases the risk that your company will miss out on some profitable segments to target.

Your current customer base is the result of your marketing and sales processes, messages, and focus. Put another way, the customers you attracted and converted are the result of your go-to-market and sales strategies. If you targeted the wrong customer base initially, interviewing and learning from only them will only help you sell to similar customer profiles.

In order to break this cycle and be more tuned in with the market dynamics, companies must interview people outside of their current customer base. This can provide powerful insights into more profitable customer segments. This is especially true if the organization wants to move upmarket and sell to larger organizations.

How many customer interviews are enough?

Another commonly asked question is how many customer interviews are necessary to create an ideal customer profile. The easy answer is as many as possible. While it's hard to give a definitive number, there is a strategy to help you figure out the right number.

Customer interviews are never identical. Some people are more talkative and extroverted, while others are more introverted, requiring significant effort to extract relevant information from them. You ’ll never have enough time to ask all your questions. The solution is to group your questions into meaningful categories. As you start hearing the same answers to similar questions from one customer, move to a new set of questions. Note: Categorize your interview questions to reflect the nine key elements of ICP that we discussed previously.

You should interview at least ten people during your customer research process. You won't be able to ask all questions in the same conversation, but in a dozen or so interviews, you can rotate through all of your questions. As you do, you will find the ones that elicit the most useful responses. Then you can focus on these questions in your subsequent interviews. You can stop conducting interviews after a few conversations in a row that don't yield new information.

Sometimes it takes ten to fifteen interviews to thoroughly understand your customers. Other times it takes thirty or more. The less you know about the industry, the more conversations you want to have. Once, I conducted over sixty calls while researching a product idea for a startup.

Your ultimate goal is to identify patterns in the responses. These patterns allow you to extrapolate and hypothesize about what you can expect across a broader set of prospective customers who fit the same profile as the ones you interviewed.

Summary

The customer is at the center of everything that you do as an organization. Effective marketing and sales start with learning as much as possible about both existing and potential customers. You’ll use this knowledge to create a brand story, design your strategic messages, develop your customer acquisition process, build a content strategy, and almost everything else. Not only will these insights guide your marketing and sales strategies and tactics, but they will also give you an advantage over every competitor who skips this vital exercise and instead takes a best-guess approach. And in the age of the customer, this positions you to win and win big.

Webinar

Free Course: How to Run Effective Customer/User Interviews

Course Outline: https://lab.mykpono.com/free-course-Customer-User-Interviews-13cbee28614780feb9b9fbe594eb145c?pvs=4