Competitive Analysis: How To Conduct A Comprehensive Competitive Analysis

In this guide, you will learn how to conduct a competitive analysis: understand market trends, identify your competitors, evaluate opportunities, analyze threats to your organization, and adjust your go-to-market and positioning strategy accordingly.

Free Course: How to Run Effective Customer/User Interviews

Course Outline: https://lab.mykpono.com/free-course-Customer-User-Interviews-13cbee28614780feb9b9fbe594eb145c?pvs=4

This article was co-authored with Nandini Jammi.

In this guide, you will learn how to conduct a competitive analysis: understand market trends, identify your competitors, evaluate opportunities, analyze threats to your organization, and adjust your go-to-market and positioning strategy accordingly.

Table of Contents

Introduction

Part 1: The Basics of Competitive Analysis

- What is a Competitive Analysis?

- Why should You Should Conduct a Competitive Analysis?

- How Not to Use a Competitive Analysis

Part 2: How to Select Competitors for Analysis

- How to select competitors for analysis

Part 3: How to Conduct a Competitive Analysis

- Company Overview

- Go-to-Market Analysis (Customer Acquisition Analysis)

- Product Offering and Pricing

- Channel

- Customer Experience and Customer Success

- Tools and Resources and Techniques

Part 4: The Next Steps

Summary

Checkout my course on How to Conduct Customer Interviews

Introduction

If the SaaS world feels like a blur these days, it’s not just you. SaaS products and services have proliferated. Product categories have gotten more crowded. A lot of their features and functionality have started to overlap. The subscription economy has made it easier to switch to competing products. The marketplace has turned into a competitive high-stakes, “winner-takes-all” environment.

New product categories are popping up every day and the lines between traditional categories and labels are starting to matter less and less to customers who just have a problem to solve. Now that customers can choose from more options than ever, it’s become much more difficult to eke out a sustainable competitive advantage.

As of 2017, there are over 5,000 products in the martech sphere alone competing for business in complex and overlapping ways. Some companies leverage their expertise and resources to enter new markets. Salesforce is a great example; look at the number of martech categories it’s listed in. With so much competition, SaaS companies can't win on features alone; they must win on brand and customer experience.

It has also become remarkably difficult to distinguish direct competitors from indirect threats - and when you do, you find competition often comes from surprising places. In fact, competition in the SaaS and tech industries is increasingly coming from indirect competitors, whose core technology enables them to invade adjacent verticals and industries.

Between 2016 and 2017, Amazon was mentioned almost 3 times more frequently by senior executives on earning calls than any other company. It’s no wonder executives at public companies are obsessed with the retail giant. Even the threat of an Amazon entrance could result in a seismic shift in the market and put them out of business overnight. In other words, the SaaS world moves fast — and the only way to keep up is to be one step ahead.

In this guide, you will learn how to conduct a competitive analysis: understand market trends, identify your competitors, evaluate opportunities, analyze threats to your organization, and adjust your go-to-market and positioning strategy accordingly.

Here’s how this intelligence contributes to a winning go-to-market strategy:

- Research can help orient your business in the marketplace

- Research can help you identify the quickest path forward

- Research can help you unearth overlooked gaps and opportunities

Part 1: The Basics of Competitive Analysis

1. What is a Competitive Analysis?

A competitive analysis is the process of identifying your competitors and evaluating their strategies to determine their strengths and weaknesses relative to your own business, product, and service. The goal of the competitive analysis is to gather the intelligence necessary to find a line of attack and develop your go-to-market strategy.

2. Why You Should Conduct a Competitive Analysis

You’ve likely heard the saying “Keep your friends close, but keep your enemies even closer.” When it comes to conducting a SaaS competitive analysis, that’s not the whole story.

In the SaaS industry, keeping your enemy close won’t prevent you from getting ambushed. Sometimes you don’t even know who your enemies are. The “enemy,” after all, could be acquired by Amazon and put you out of business overnight. Or Google could build a competing product in your market.

Here’s why you should conduct a SaaS competitive analysis, or “study the enemy.” Studying the ‘enemy’ can help you understand the battlefield. It can help you identify where the “enemies” are and how they’re approaching the business. It can help you discover strategic areas where you can position yourself for a win.

A competitive analysis won’t help you with pressing business decisions, such as what product feature to build next. Never copy your competitors for the sake of it; they could be 100% winging it! Moreover, if you’re the industry leader, the value of analyzing competitors is limited because you’re the one leading the pack through uncharted territory.

It will, however, help you develop a high-impact go-to-market (GTM) strategy.

Understand Market Conditions

A company rarely competes against just one competitor. In fact, in many cases, the biggest competition in the SaaS and tech industries is coming from indirect competitors. These competitors hold a commanding position in their core market, allowing them to expand into different industries and verticals. Who would have thought that Uber and Google would become die-hard competitors in the autonomous car market? As I wrote previously in my analysis of sales enablement and acceleration industry, it is almost impossible to distinguish direct and indirect competitors. In many SaaS verticals everyone competes with everyone.

Identify Strengths and Weaknesses

A good competitive analysis helps identify the strengths and weaknesses of your company in relation to the alternatives.

You need a keen understanding of your ideal customer and the market so that when you launch, your product is positioned correctly in the ecosystem of all products and services. Since competition can come from anywhere, you need to catalog your strengths and weaknesses relative to both direct and indirect category leaders (i.e., those adjacent to your core business).

Design / Adjust Go-to-Market (GTM) Strategy

An effective GTM strategy requires a deep understanding of your ideal customer, market and competition, product offering and pricing, and channels necessary to reach your customers. Competitive analysis helps you understand market dynamics so you can find an optimal way to reach your target customers. Analyzing your market and competition also helps you determine how your company and your product fits in the current environment.

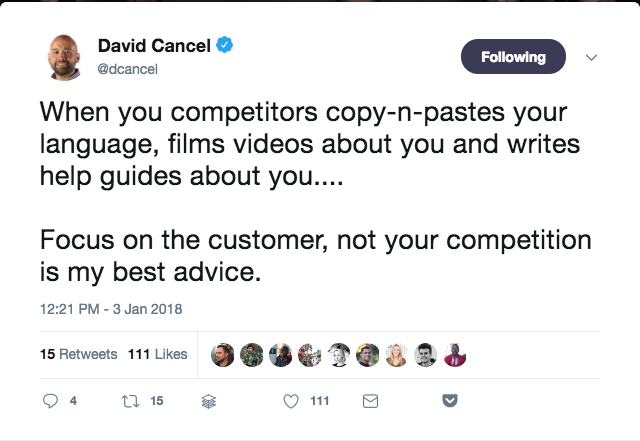

3. How Not to Use a Competitive Analysis

You’ll never be able to fully understand or duplicate a competitor’s strategy. A competitive analysis is just one input in your growth strategy — and a limited one at that. You don’t want to look to your competitors for marketing tactics. They might be spending thousands on Facebook ads, but that doesn’t mean it’s working.

You also don’t want to launch a new feature just to keep up with a competitor. For all the talk of the data-driven workplace, you’d be surprised how many product decisions are driven by petty internal politics or a micromanaging HiPPO (Highest Paid Person’s Opinion).

Don’t use competitive analysis to make decisions on what to build next. Your next idea isn’t going to come from your competitors. It should come from customer feedback, talking to prospects, and ideas your colleagues are sharing internally across your company.

Avoid industry research. Industry analysts aren’t good at predicting disruptive companies and cutting-edge trends because such changes occur at the bottom of the market, which is generally not on their radar. Research giants like Forrester and Gartner provide industry consensus after major shifts have already occurred. Plus, they derive their research by analyzing large organizations, so startups won’t find what they’re looking for here.

Don’t spend too much time on it. Treat your competitive analysis as an ancillary activity. It shouldn’t consume too much of your time and resources. Focus on what your customers are telling you, whether through feedback, interviews or their in-app behavior. They will always be your strongest source of data and insights.

Part 2: How to Select Competitors for Analysis

4. How to select competitors for analysis

Competitive analysis is an exercise of comparing your business, product, and service to companies and finding similarities and differences. The most critical part of kicking off a competitive analysis is choosing the right competitors to analyze. Otherwise, you will spend tons of time on competitive research with very limited insight to show for it. In other words, the competitors you select determines how you will perceive your company and the final analysis.

Remember that martech landscape map with over 5,000 companies? Almost every product category is made up of over a dozen different players. You can’t reasonably expect to analyze all of them. You don’t need to either. An ideal competitor analysis includes three to five companies that represent the biggest threat to your business. (Go with five if you’re operating in a crowded market.)

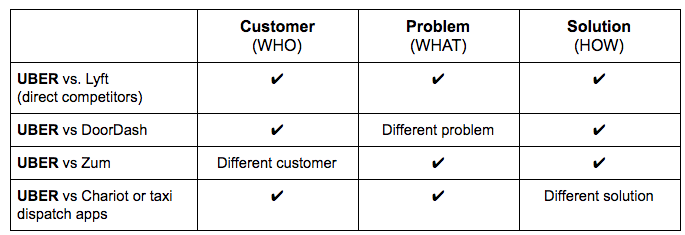

But how can you develop a list that accurately reflects your real competitors? Here’s what you need your organization to align on first:

1. Customer (WHO)

Who are your target customers (and companies)?

2. Problem (WHAT)

What core problem does your product solve for your target customers?

3. Product Category (HOW)

How do you solve this problem? Are you solving this problem with a unique technology or process?

Direct competitors are companies that sell to the same customers and solve the same problem using the same or similar solution (technology). The diagram below shows how Customer, Problem and Solution overlap into direct competition.

Direct competitors solve the same problem for the same customer using the same solution. By solution, I mean a similar technology or approach to the problem — one that seems indistinguishable to the customer. For example, Uber and Lyft are direct competitors.

Direct Competition = same customer + same problem + same/similar solution

Some competitors sell to the same customer using the same (or similar) solution but solve a different problem. For example, UberEats sells to the same customers but solves a different problem: food delivery instead of transportation. For UberEats, DoorDash and GrubHub are good examples of direct competitors.

Different Problem = same customer + different problem + same/similar solution

Some competitors solve the same problem with the same technology but focus on a different customer. For example, Zum provides schoolchildren with rides to school, solving a transportation problem for kids and parents. Zum solves a slightly different problem too: safety. Safety is the primary concern for parents when it comes to kids riding back from school. However, it’s ultimately grounded in the same tech as Uber.

Different Customer = different customer + same/similar problem + same/similar solution

Some companies solve the same problem for the same customer but using a different solution. It can be different in terms of technology or process. For example, Chariot provides group transportation services for commuters and employees, using a completely different approach to solving the same problem for the same customers of taxis.

Different Solution = same customer + same problem + different solution

The table below summarizes how to evaluate companies for competitive analysis selection. This approach is not ideal and might not work for every company since each one operates in its own complicated ecosystem. But it provides a basic framework for selecting competitors.

Limiting your organization to direct competitors only might lead you to a very narrow view of the market. This framework allows you to evaluate companies that aren’t just your direct competitors but companies that could easily move into your turf. You want to consider companies that aren’t currently in your category but could potentially leverage their product or technology in your space.

Outside of direct competition, the most dangerous competitors are those that sell to the same target customer. These companies already have access to customers so it’s much easier for them to provide products or services that solve another problem for the same customers.

Alternatives

Alternatives can satisfy similar or related customer needs with completely different functionality. It’s essential to understand these so you know what you’re up against and can position accordingly. For example, an alternative to Uber is a taking a walk or taking a taxi or riding a bike. Read more about alternatives.

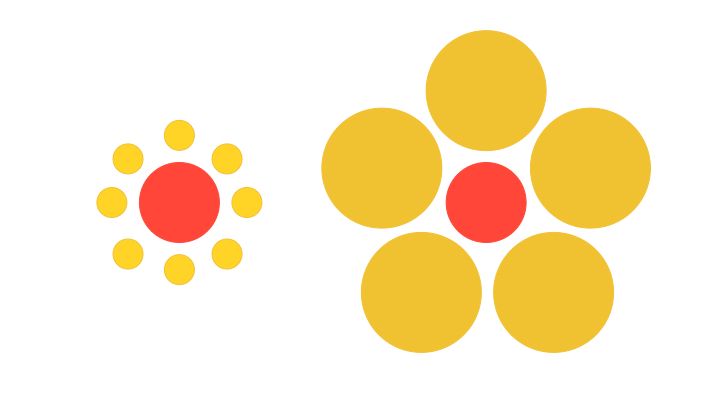

Company Size

It’s a mistake to think you should only analyze competitors of a similar size to your company.The image below was used by Dan Ariely in his book Predictably Irrational to demonstrate the concept of relativity.

Notice that the red circle on the left looks larger than the red circle on the right. Contrary to our gut feeling, both red circles are the same size. The one on the left seems large when compared to the surrounding smaller circles. And the red circle on the right seems smaller next to larger circles.

This illusion helps illustrate how important it is to consider your relative position against your competitors. Your company can look bigger and further ahead compared to smaller competitors and can look unreasonably smaller and behind when compared to larger competitors.

You can set up a much more balanced view if you look at both market leaders (often larger companies), as well as smaller, often more agile and younger companies.

This allows you to calibrate where you fall along the spectrum. Are you growing faster than a company of your size and age? Are you doing about as well as a current market leader back when it was a smaller business too?

That context becomes helpful as you are deciding which companies to include in your competitive analysis. The more comprehensive your view of the competitive landscape, the more effectively you can identify potential opportunities for your company.

Part 3: How to Conduct a Competitive Analysis

Now that you’ve finalized a short list of competitors, you’re ready to begin the real work. To kick off a competitor analysis, start by collecting the basics and drilling down from there.

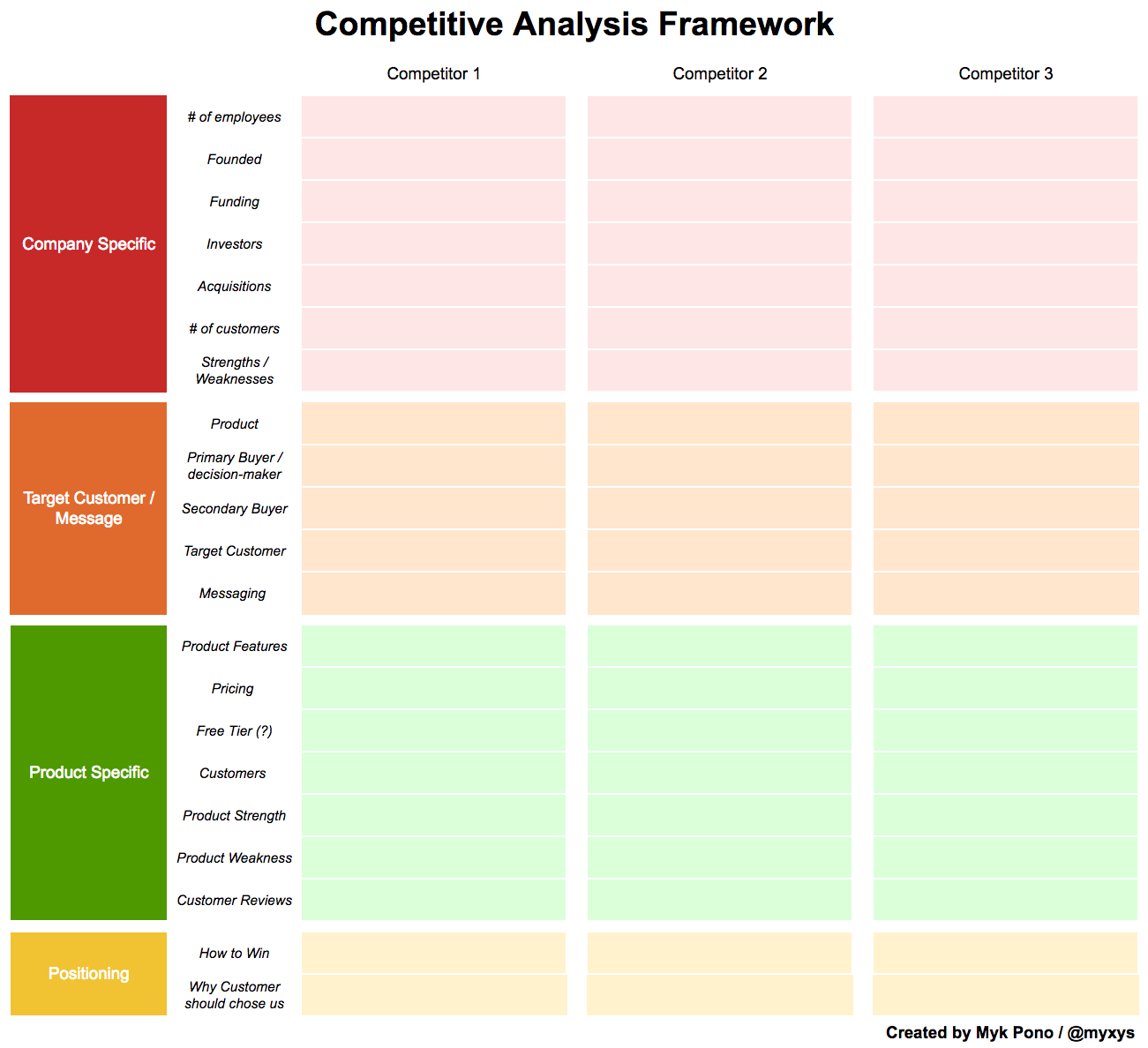

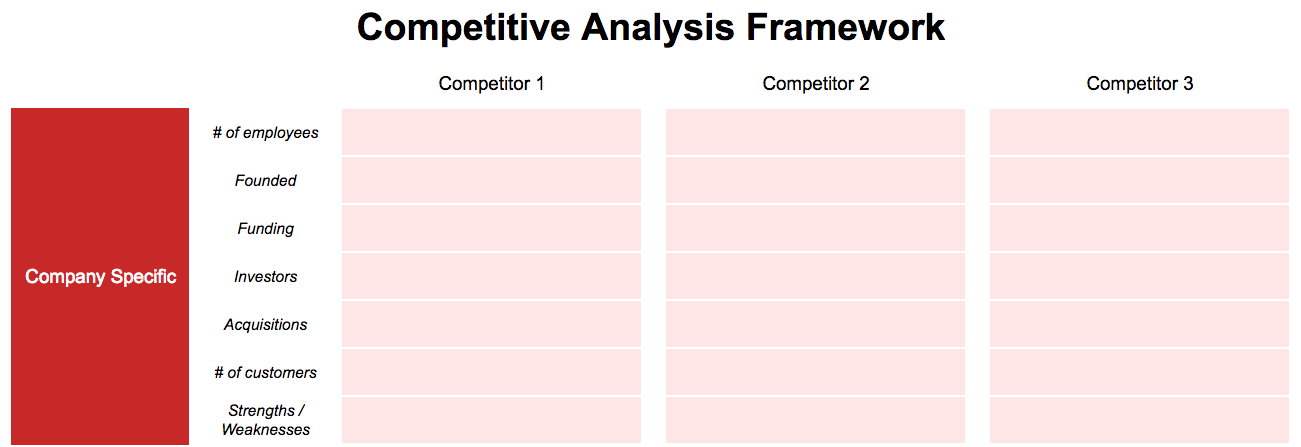

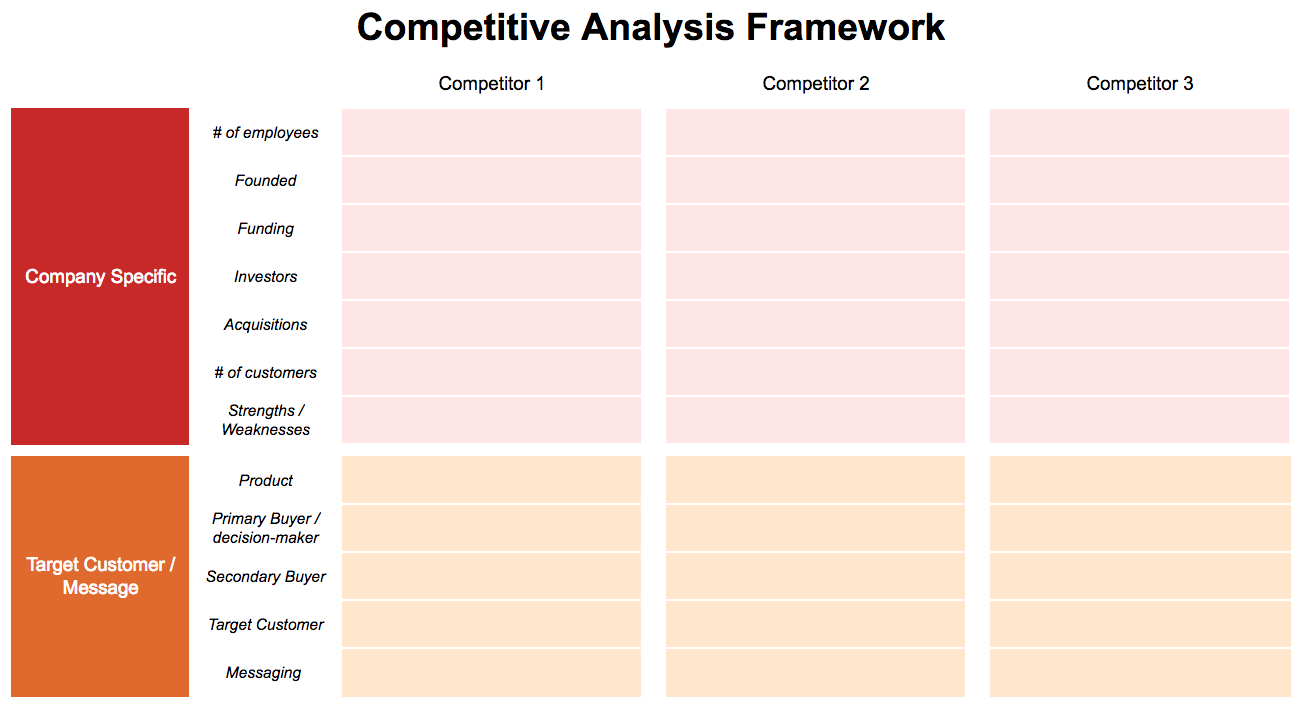

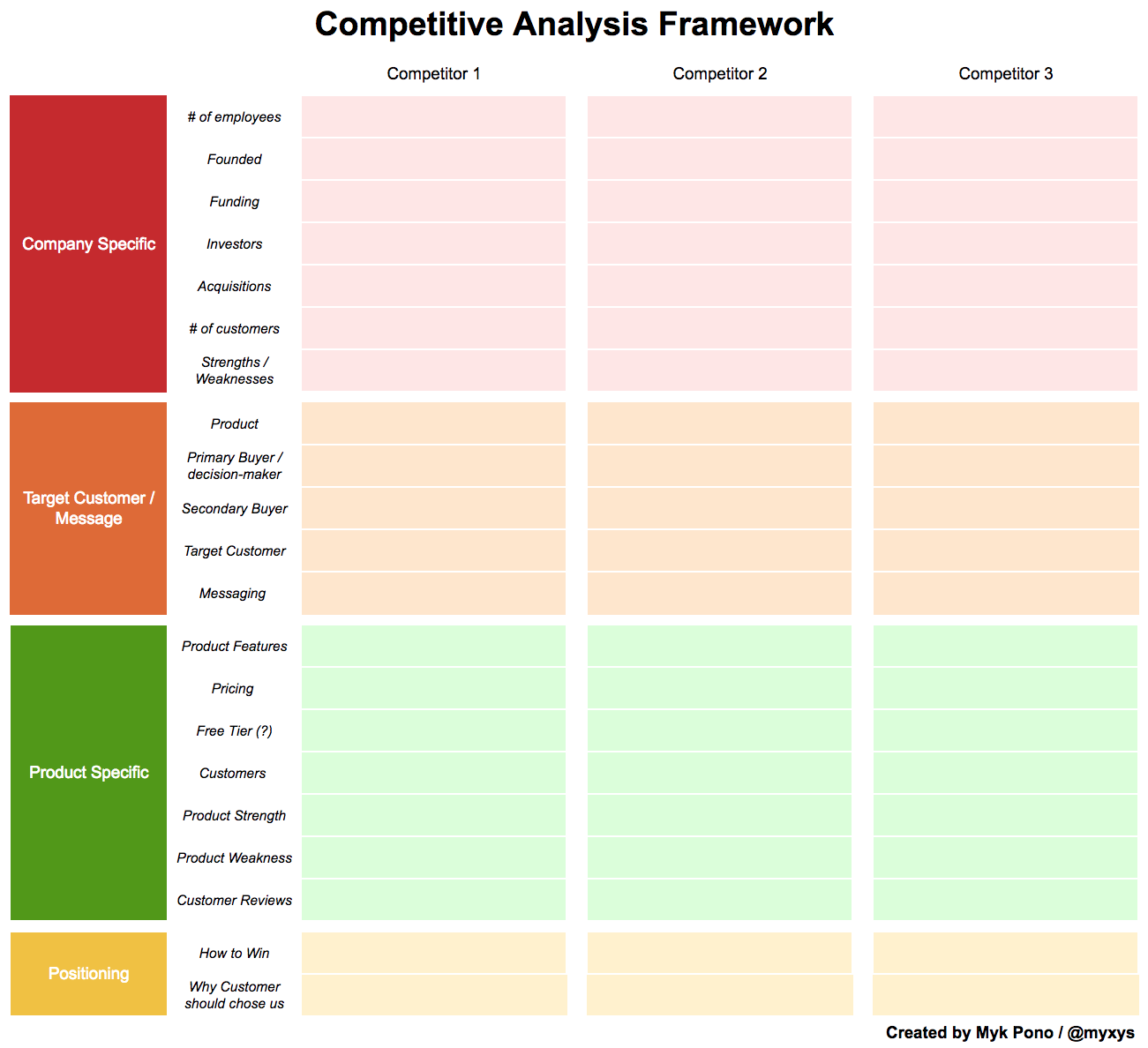

5. Company Overview

Why is it important to track your competitors’ founding date, fundraising rounds and employee count? So you can use it as a benchmark against your own growth. If your company is a year old, how fast did your competitor grow when it was at your stage? How much revenue was it generating? How many customers did it have?

If you’re a startup facing off against the dominant market leader, you could use this data to set yearly goals and projections for your business. You can easily find a company’s “biographical” information on sites like Crunchbase, LinkedIn, Owler, and AngelList.

Employee Count

If you can’t find a company’s revenues online, Jason Lemkin of SaaStr offers a simple formula you can use to calculate a ballpark revenue estimate, simply based on the number of employees at the business (read more). Linkedin is usually the best source to find an active employee count.

Founding Year

Knowing a company’s founding year helps you put things in context in your overall analysis. You’ll find it useful as you chart their past growth over the years — a helpful comparison as you establish your own business goals.

Investors

Typically, VCs make just one bet in a product category to avoid cannibalizing their investments. You are either an Uber or Lyft investor. This is a commonly accepted view in the Valley. If you see a VC’s name missing from the category you’re competing in, they might be a good candidate to approach for fundraising. They missed the chance to invest in your competitor, but now they have the opportunity to work with you.

Number of Customers

It’s unlikely that you will find an exact customer count for your competition. But a good guess is all you need — as long as you have a relative sense of where each competitor stands in the hierarchy.

You can often find some clues by researching press releases. Companies often brag about reaching certain milestones in revenue or number of customers. Technology tools such as Datanyze can tell you how many websites include your competitor’s product tag. Product review platforms such as G2Crowd can be helpful too.

Mergers and Acquisitions

Mergers or acquisition is one of the easiest ways for companies to enter a new market or get rid of a competitor. When a web analytics company acquires a mobile application monitoring company, the writing is on the wall. It’s about to enter a new market. Research your competitor’s M&A history to get a sense of the direction it’s moving in.

Market Share

It’s not easy to find information on market share. Large companies invest millions of dollars to investigate market share but most SaaS companies don’t have such resources. The best shortcut is to conduct a survey with a sample size of 200-300 respondents, asking them what tools and solutions they are using. That’s usually just enough to get a ballpark estimate of market share in the SaaS industry.

Organizational Strength and Weakness

Before we look at product strengths and weaknesses (which we’ll do in a bit), it’s worth understanding what makes your competitor unique from an organizational perspective.

For example, is the CEO considered an industry influencer? Does he or she have a significant social media following? That’s important to make note of, as this is a unique strength that can’t be easily replicated.

You should also consider how company culture and internal processes impact the business and its bottom line. Netflix is widely admired for its “no brilliant jerks” policy at the company. This is one of many factors that helps it recruit and retain top talent year after year.

This goes back to the DNA of the business — it’s a strength you can’t just copy.

I can’t resist mentioning Travis Kalanick, who, in my opinion, was always the strength and weakness of Uber. You can hardly imagine a person with any other personality creating a once-in-a-generation company in the transportation industry, with its complex ecosystem. Think otherwise? Brad Stone covers the rise of Uber in his book Upstarts.

Surprisingly, you can mine a lot of useful intelligence from employee reviews on Glassdoor. Because employees leave anonymous feedback, they don’t hold back on what they love (and don’t love) about their employer. You can often uncover cultural aspects of the organization by reading how employees perceive senior leadership and whether or not they enjoy working there.

Summary of questions:

- What is the total number of employees your competitors have?

- Are your competitors expanding or scaling down?

- How old is your competitor?

- In what geographical market do they operate?

- How much have your competitors raised thus far?

- Who are your competitor’s investors?

- What is your competitor’s customer count?

- Can you estimate your competitor’s growth rate or revenue?

- Have your competitors acquired companies? If so, in what industries?

- What is your competitor’s market share?

- What are your competitor’s top organizational strengths and weaknesses?

6. Go-to-Market Analysis (Customer Acquisition Analysis)

Now that you’re done collecting company information about your competitors, it’s time to dive deep into their go-to-market and customer acquisition strategy.

Remember: An effective GTM strategy requires an understanding of these five elements:

- Target customer & strategic messaging

- Market

- Product offering and pricing

- Channel

- Customer acquisition strategy

These are a sampling of the questions you’ll need to answer as you do your research:

- What are the characteristics and needs of each competitor’s ideal customers?

- How does each competitor acquire new customers?

- What type of content do they publish and what topics do they cover?

- What is their sales process - what channels does it involve, how long does it take, how involved is the sales team?

- How easy is it for customers to switch away from your competitors?

- What are the barriers to entry in the industry and in relation to each competitor?

6.1 Target customer

In B2B, the term target customer (or ideal customer profile) refers to both the company and decision maker profiles. We can’t fully grasp the pains and challenges of a decision maker without looking into his/her organization — and their stakeholders. Larger organizations can throw more money at problems than a smaller, more agile company. Even decision makers with the same title, same goals, and same challenges might have different priorities and stakeholders to convince depending on the size of their organization.

Put yourself in the shoes of your competitors and understand their customers:

- What kind of companies do your competitors sell to (size, revenue, vertical)?

- Who is the primary decision maker and economic buyer?

- What are the primary goals for your competitor’s customer?

- For your competitor’s customer, what are their daily activities, success metrics, and challenges?

- What organizational functions are involved in the buying decision?

Here are a few places to look for this information.

Competitor’s website

Most companies display customer logos and case studies on their website. Look for patterns in the types of customers they’re featuring, including characteristics like size, location, industry, and revenue. Those will give you some pretty strong clues into the kind of customers they’re targeting.

Data analytics and enrichment product

Want to know what tech stack your competitors are using? Datanyze is a great tool for finding out. It analyzes millions of websites and finds snippets of code that tell you what integrations, platforms and plugins are behind a company’s product.

Product reviews

Of course, your goal isn’t to compile a list of your competitor’s customers. You should be on the hunt for patterns that help you identify why your customers are choosing your competitors.

Mining product reviews helps you get valuable voice-of-customer data — including pains and problems that you can use to develop your own strategy.

Customer reviews are also a great place to find so-called “trigger events” that lead customers to look for a new product or service solution.

For example, if a company opens a new office, it needs services that will help find a new office, set it up, and move furniture to a new location. Therefore, opening a new office can be a trigger for searching for a solution that helps companies assist in this process.

This is an important part of the buying process and customers are usually happy to share this information in their reviews.

6.2 Strategic messaging

Strategic messaging is the most visible part of your marketing, including your copy and brand. Companies often go into full messaging wars against each other because it gets so easily noticed. You change a headline message on your homepage, then your competitor retaliates with a new message of their own.

Strategic messaging isn’t a brand exercise nor is it a copywriting project — it goes beyond conveying feelings and emotions.

Strategic messaging is a value-based communication framework that companies employ in all interactions with stakeholders — employees, prospects, customers, partners and investors.

Strategic messaging communicates product value in a way that resonates with each stakeholder involved in the buying journey.

Read your competitor’s press releases, analyze their website (including their About Us page), and read their content to understand:

- What story are your competitors communicating to customers?

- How does your competitor position its product?

- How does your competitor describe its value proposition and benefits?

- What words and phrases does your competitor use to describe their company, product, and value?

- What is your competitor’s one-sentence company description?

Product positioning

Software products often include many features and solve multiple problems. But what problems does your competitor's product focus on most?

Look for patterns that highlight your competitor’s product focus.

Content Strategy

- What does your competitor write about?

- What topics are covered on the company blog, and in their whitepapers, research, videos, podcasts and other resources?

- How do prospects/customers respond to your competitors’ content - do they share it, comment on it, like it?

7. Product Offering and Pricing

After you understand your competitor’s customers and messaging, you can move to analyzing its product offering. First, outline what your competitor’s product can and can’t do.

Product Feature Analysis

List all the features that your competitor offers and outline the value that each feature brings to customers. Create a map of your own features and values that overlap with your competitors.

- What are your competitor’s core product features?

- What product features are unique to your competitors?

- How do your product features compare to the same features of your competitor?

- Does your competitor support multiple environments (e.g., web, iOS, Android)?

Pricing and Average Selling Price (ASP)

- What is the minimum price your competitor charges?

- What is the ASP?

- What are the main factors that impact price (number of seats, volume etc.)?

Product strength / weaknesses

- What are the strengths of your competitor’s product?

- What are the weaknesses of your competitor’s product?

- How do customers perceive your competitor’s product design, quality, and price?

7.1 Customer Acquisition Model (Freemium vs Free Trial)

A customer acquisition strategy explains how companies attract and convert prospects into customers.

- How does your competitor market its product?

- Does your competitor offer a free trial or freemium?

- How difficult is it to switch away from your competitor?

Switching costs

The SaaS revolution drastically reduced switching costs across the board. On-premise solutions required expensive servers and software and an often onerous onboarding process. Today, it is much easier to swap one SaaS product for another.

But switching costs, or the cost that a customer incurs as a result of switching products, still exist. Technology can be a driver of higher switching costs. When a product is integrated with multiple systems and APIs, switching to another product becomes increasingly difficult. Such a switch usually results in business interruption and the need to retrain staff, among other unwelcome effects.

Switching costs are a significant barrier to switching to a new product, which makes it a key part of your competitive analysis.

Unique Barriers to Entry

Barriers to entry are high costs or other obstacles that prevent new competitors from easily entering an industry or area of business.

Tom Tunguz highlighted the three barriers that prevent competitive entrance: data network effect, network effects, and ecosystem creation (read more). Do your competitors have any of these core barriers to entry?

Protecting your company with one of the core barriers is smart. Nailing down two barriers is even better. Slack is a great example of a company that has a network effect, having successfully created widespread demand through word-of-mouth referrals and a highly engaging product. It has also invested in building strong relationships with developers. Slack’s developer platform roadmap and its commitment to transparency for developers has helped the company build a strong ecosystem around its product.

Today, Slack’s rich ecosystem is one of the many competitive advantages the company has strategically cultivated over time.

Business Models

When you conduct your competitive analysis, it's worth analyzing the sales models of your competitors. In his article Three SaaS Sales Models, Joel York describes the three most common SaaS sales models based on the relationship between price and product complexity. Companies with low priced and low-complexity products must focus on developing a self-service option so they can maintain a healthy relationship between customer acquisition cost (CAC) and customer lifetime value (CLV). Slack, Trello, Dropbox, GitHub are all low-price, low-complexity products.

A transactional sales approach to customer acquisition is best for products with a higher average selling price (ASP) then self-service solutions. Customers expect to see a demo, or even try the product. In fact, when customers are paying more, they expect more hand-holding throughout the process. While this can drive up organizational costs and complexity for a SaaS vendor, it can yield significant revenues and long-term customer loyalty. For this approach, companies need to optimize their sales, marketing, and support in a way that allows them to build a relationship with the customer over the customer lifetime. Most SaaS companies fall under this category.

The enterprise sales process is reserved for highly complex products sold at a high price. Because enterprise products provide so much value and prospects take longer to evaluate the product, companies must adopt a complex selling process and longer sales cycles. Selling to large enterprises with a high ASP means competing against rivals with high-touch sales models.

If your competitor is focused on a self-service model, you need to position your product and sales process to be more focused on the customer relationship. If you also rely on a self-service model, you need to compete on brand or some other factor. In other words, you won’t be able to compete on product since switching will be fairly easy.

If you are selling a high-priced, complex product then you should focus on competitors pursuing similar enterprise clients. However, remember that self-service competitors are always a threat so you need to continually monitor their feature releases.

8. Channel

You and your competitors are competing for the attention of potential customers. That’s why it's useful to know how your competitors use social media channels and paid acquisition channels to reach their target audience. While digital channels are key in today’s marketplace, you also need to pay attention to offline channels like events, meetups, conferences, and direct mail. This is where the face-to-face interactions occur that are often the key to establishing connections and sealing deals. You can usually find out information about offline events by visiting the “Events” section of your competitors’ websites and also searching for their names in relation to conferences and events on the wider web.

- Where do your competitors advertise?

- What keywords do they buy on Adwords?

- Do they advertise on Youtube, Facebook, Linkedin, Twitter or other social media platforms?

- Do your competitors focus on selling in specific verticals?

This article features 13 tools you can use to analyze your competitors’ marketing channels.

9. Customer Experience and Customer Success

It pays to understand how satisfied are customers with a competitor product. In the end, nothing matters more than the customer experience in determining a company’s success. The best way to get this information is from review platforms

- How do customers like your competitor’s product?

- What do they like the most about your competitor?

- What do the like the least about your competitor (top complaints)?

- What’s the Net Promoter Score (NPS) of your competitors?

- How loyal are customers to your competitor’s product?

- What is the one thing that’s most highlighted in customer case studies?

- Do customers complain about support or product failures?

- How quickly do your competitors respond to customer service questions on social media?

A few great places to find customer reviews: G2 Crowd, Trust Radius, Capterra, Software Advice, GetApp, Founderkit, and Appbot, among others. Another option is to interview your customers and prospects to learn how they view your product and competitor's product.

10. Tools and Resources and Techniques

As you conduct your competitive analysis, you can call upon many tools and techniques to get the job done effectively. I’ve mentioned a few throughout this guide, but here’s an at-a-glance list with additional resources.

Technology and techstack:

- Datanyze - As mentioned earlier, this tool analyzes millions of websites and finds snippets of code that tell you what integrations, platforms and plugins are behind a company’s product.

- Similartech - Similar to Datanyze.

- Builtwith - Find out what technologies are being used on specific websites.

Company Profiles:

- Crunchbase - Discover industry trends, investments, and news about your competitors.

- LinkedIn - Where you can find out a competitor’s “biographical” info. Usually the best source to find an active employee count.

- Angel.co - See which startups are hiring and for what positions.

- Owler - Similar to Crunchbase.

- DataFox - Its database shows which companies use more than 14,000 technology solutions, which you can search through using the Similar Company Algorithm.

- Mattermark - See company profiles, key personnel, and growth signals related to your competitors.

- Slideshare - Find competitor product or funding slide decks here.

Product reviews:

- G2Crowd - The best resource to learn what customers think about your products and competitors.

- GetApp - Similar to G2Crowd.

- TrustRadius - Similar to G2Crowd.

- Quora - See questions or discussions about certain products or topics that might be helpful in your competitive analysis.

- YouTube - Find product demos and presentations.

Website traffic:

- SimilarWeb - Provides website traffic comparison.

SEO & SEM:

- SEMrush - Helps you understand your competitors’ focus in search engine marketing, including best-performing keywords, along with their spend.

It's quite likely that no prospect or customer reads your press releases as carefully as your competitors do. Press releases are helpful in understanding a company’s strategic focus. Sometimes PRs show your competitors’ customer count. The About section in a press release shows your competitor's strategic messaging. These two to five sentences are how your competitor wants their customers and prospects to perceive the company and its products.

Part 4: The Next Steps

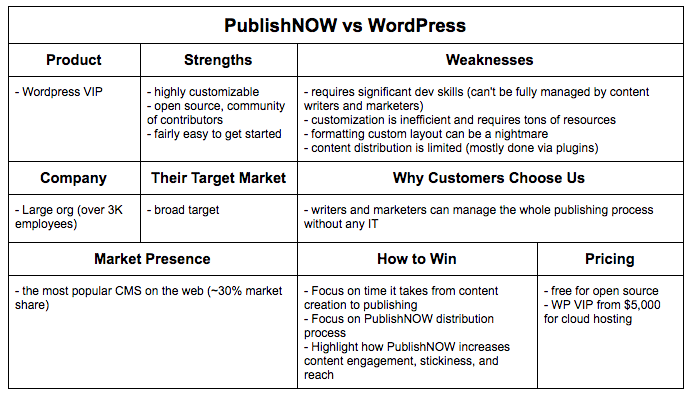

The primary goal of a competitive analysis is to understand the marketplace and how you can differentiate from other players. At the end of a competitive analysis, you should create a battlecard for each competitor. A competitive battlecard is essentially a quick visual reference for your sales and marketing team, guiding them as they position your organization against competitors.

Sample Battlecard: PublishNOW vs WordPress

Here’s a fictitious battlecard using two real companies, describing how a new PublishNOW product will be positioned against WordPress. PublishNOW is a content publishing platform for marketers and writers to improve content engagement, content stickiness, and reach. WordPress is a blogging platform.

The battlecard helps sales understand the strengths and weaknesses of WordPress and how to win customers when going up against them.

Summary

By following the steps outlined in this guide, you can effectively conduct a competitive analysis:

- Select competitors for analysis, including both direct and indirect competition

- Gain an overview understanding of each competitor

- Figure out how each competitor goes to market and acquires customers

- Analyze the product offering, including features, price, strengths, weaknesses, whether it’s offered as a freemium or free trial, and the competitor’s overall business model

- Identify the channels competitors use to advertise and deliver their products

- Analyze the satisfaction level of your competitors’ customers

- Use all this information to populate your competitive analysis framework and competitor battlecards

Remember: The idea of a competitive analysis isn't to overly focus on the competition but to understand where your company stands in the marketplace and identify opportunities to further differentiate. At the end of the day, a focus on the customer will serve your company far more than a focus on the competition. Done well, a competitive analysis can help you find ways to outplay the competition by better serving customers — theirs and yours.

Resources:

- SaaS Startup Strategy | Three SaaS Sales Models by Joel York

- The 3 Competitive Defenses of Enduring SaaS Companies by Tomasz Tungus

- A Step-by-Step Guide to Conducting Competitive Analysis by Svitlana Graves

- Stop Ignoring Your Competitors And Learn How To Do Competitor Analysis Instead by Product Habits

- How to Write a Great Business Plan: Competitive Analysis by Jeff Haden

- Why Competition Is So Bitter in SaaS: Oligopolies and Dominant Strategy Equilibriums by Jason Lemkin

- How do B2B SaaS markets evolve with 10+ competitors? by Jason Lemkin

If you like this article please recommend and share.

Follow me on Twitter, Medium, Quora, Instagram, connect on Linkedin. Join my Telegram channel - Marketing Journal - to discover interesting articles, books, and resources on marketing, product growth, startups, and SaaS.

Send me email with comments and questions: myk[at]myxys.com.