Course 1.1: Customer Interviews | The Key to Planning Successful Customer Interviews

Updated: https://lab.mykpono.com/free-course-Customer-User-Interviews-13cbee28614780feb9b9fbe594eb145c

1.1. The Key to Planning Successful Customer Interviews

Let’s dive into the first part of the customer interview process: planning successful customer interviews.

I’ve created a 5-part framework for successful customer interviews. Here are the five factors you should always consider:

1. Formulate the problem

2. Ask the right people

3. Ask the right questions, in the right way

4. Create a uniform structure for customer interviews

5. Record feedback

Let’s start with #1, formulate the problem.

Before you start engaging in customer interviews, you need to know WHAT you want to learn from them. That’s the problem we need to formulate.

There are two ways to think about formulating the problem:

- formulating problems based on your organization’s objectives, and

- formulating problems based on your customer’s experiences.

We’ll tackle organizational problems first.

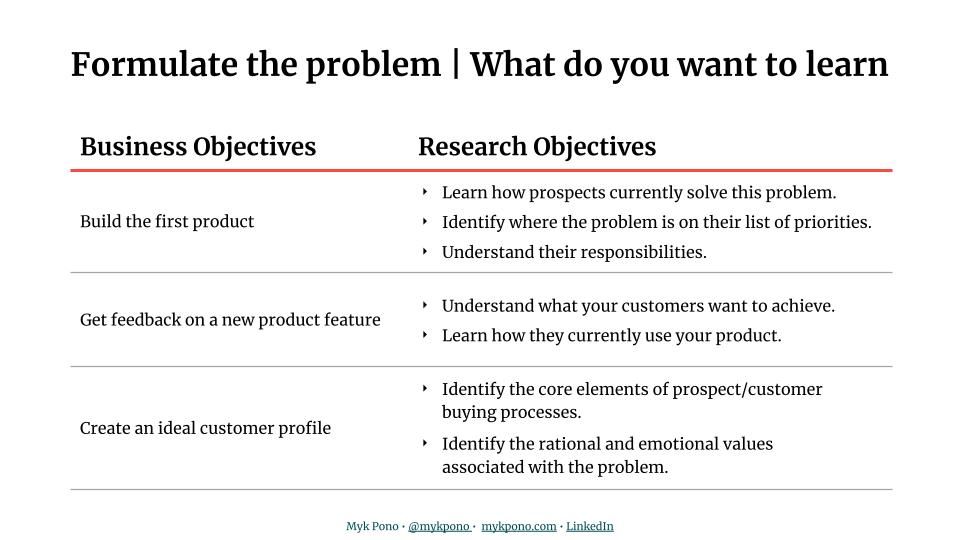

To start, think about your company’s business objectives. Then break that down into research objectives. I’ll give you an example.

Imagine that your business objective for doing interviews is to build your first product and make it as successful as possible. In this case, you’re talking to prospects, since you won’t have customers yet.

So what would your research objectives be if you are using interviews to build your first product?

Here are a few:

1. Learning how prospects currently solve the problem you want your product to address. This will give you a sense of your competitors AND any gaps in existing solutions.

2. Identifying how high on their list of priorities solving the problem your product addresses is.

Maybe you think a pain point will be a very high priority for your target customers.

But if talking to prospects reveals that there are plenty of other problems that are a bigger deal to them, you may face an uphill battle selling a solution to that problem in the future.

3. Better understanding their role. Knowing how your prospective customers operate will help you design a product that fits naturally into their existing workflows -- or how those workflows will change with your solution.

Let’s consider another common example. Say your business objective is to get feedback on a new product feature you’re thinking of building. What should your research objectives be?

1. Understanding what your customers want to achieve so that you can zero in on how exactly to build out and implement the new feature.

2. Learning how they currently use your product, so that you can see how any new feature additions would change or support their existing workflows.

Finally, take the business objective of creating an Ideal Customer Profile.

Customer interviews are great for these because they ensure you’re building your profiles off real people’s experiences, not just your assumptions. A few research objectives you might choose to focus on include:

1. Identifying the core elements of your customer's buying processes, such as how they’re involved in the decision-making process or how they choose between different options.

2. Identifying both the rational and emotional values they associate with the problem your product is intended to solve.

The second way to formulate the problem is by thinking about the problems your customers experience.

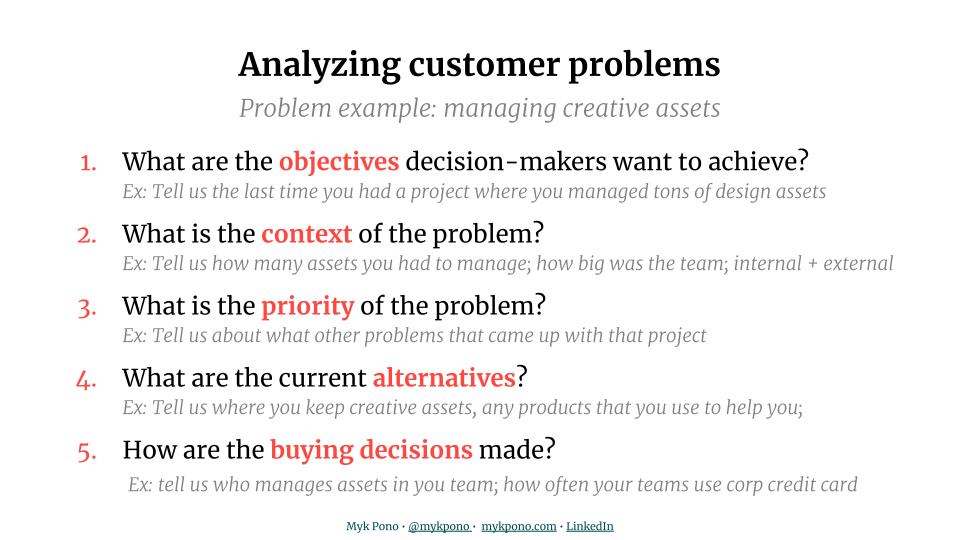

Let’s say I’m building a tool for managing creative assets. How would I formulate the problem?

There are 6 questions I would ask to come up with my goal for prospect interviews:

1. What are the objectives decision-makers want to achieve?

In the case of my creative asset management product, I might want to ask prospects to tell me about the last time they worked on a project where they had to manage a ton of design assets.

- What objectives did they need to achieve in that role?

- What would an ideal solution look like for them?

- What does success look like to them?

2. What is the context of the problem?

Here, you might want to ask subjects to tell you about the last project they managed that had a lot of marketing assets involved - maybe something like building a new website.

In that case, you want to understand how many people were involved, how many assets were shared, and whether the project used internal or external stakeholders (or both). This will build the context around the problem you want to solve.

I would consider other questions such as:

- What was the budget?

- Did they complete the project on time?

- If not, what other problems did they face?

3. What is the priority of the problem?

With this question, I want to know if managing creative assets was a big struggle for them, relative to other problems that came up during their last design project.

Because I asked them to describe all the problems they faced, I can now ask them to prioritize the problems overall.

If the problem you're trying to solve is number 10 on their list of priorities, that’s probably not a big enough problem.

So you have to either change the problem you’re solving or figure out if you’re talking to the right person.

The problem may be a top priority for the person in one, but further down the list for another. For example: managing creating assets may be more important to marketing managers but not for the VP of marketing in the same organization.

4. What are the success factors?

Were they able to successfully manage creative assets on their last project? If so, what made them successful?

5. What are the current alternatives?

Chances are, your interview subject has some solution in place. Maybe it's your competitors, and you want to understand how the solution works for them. Maybe they don't use other products, or they have a homegrown solution.

So you'll want to understand how they manage those assets right now. Do they have them in Google Drive? Dropbox? Do they have them in both, so that people struggle to find them in different places?

Is it a situation where everybody has their own folders, and they just copy assets from one folder to another as needed?

6. How do they make their buying decisions?

Here, I want to learn who manages assets on the team, who selected their existing storage method, who has the decision-making power to adopt a new solution, and even how often their team can use the corporate credit card.

For example, if you're trying to research the price point of your product, it would help to know what their typical budget is.

- Do they have a company credit card?

- How much can they spend on it?

- If your product is above this budget, who will have to approve it?

- Is there a purchasing department? Or

- Will they have to file a Purchase Order to buy your solution?

Now, no matter how you’ve formulated your problem, it’s a good idea to make a guess about the kinds of responses you’ll hear from interview subjects, based on what you want to know.

Setting a hypothesis up from the beginning will give you something to validate your conclusions against. It also provides you with ideas for future inquiry.

For example, if you get responses that don’t line up with your hypothesis, what happened?

Why did a disconnect occur?

Having established hypotheses ahead of time will help you later on when it’s time to analyze the data you’ve collected.

For example, when I was conducting interviews before building the publishing platform Publishnow, we assumed that our audience is aware of how complicated and time-consuming content publishing and distribution are.

But as we progressed with the interviews, it became clear that most people got used to the process and didn't see it as complicated.

So instead of asking whether their content publishing process was complicated or not, we asked them to describe the process to us.

Then we asked them how helpful it would be if we could remove a few steps in this process. This way we brought awareness to the whole process and assessed the value of making it easier.

As you can see, it was helpful to have an assumption going into the interviews so that when we realized our assumptions were wrong, we could quickly pivot to get better information.

However, remember, customer interviews should generate surprising feedback, so there is no reason to stress if your hypotheses are wrong.

That's why you are conducting interviews in the first place, to test your assumptions!

Summary:

- Based on what you want to know, make a guess about the kinds of responses you’ll hear from interviewees

- At the end of the process, this will give you something to validate your conclusions against and provide ideas for future inquiry

- If you got responses that didn’t match your hypothesis, what happened? Why is the disconnect occurring?

- Ask the right people